Gold Fundamental Forecast - Neutral

- Gold prices continued ranging after Fed, watching US Dollar and bond yields

- The focus shifts to US inflation data, but will it be able to impact policy bets?

- Fed Chair Jerome Powell will speak, elevated bond yields a barrier for XAU

Anti-fiat gold prices faced a fairly busy week, with key items such as the Federal Reserve rate decision and the US non-farm payrolls print. XAU/USD remains tilted lower since prices topped last year as the yellow metal has been struggling to gather upside momentum. This likely speaks to the tough medium-term path for gold.

The Fed is going to begin tapering asset purchases this month to the tune of $15 billion, finishing the process by the middle of next year. But, the central bank still remains broadly patient on rates. While there has been a pickup in inflation as of late, policymakers anticipate bottlenecks to gradually lift, bringing down general price growth.

This commentary, outlook on rates and the size of the balance sheet likely resulted in front-end government bond yield weakness. Still, the US Dollar spent most of this past week appreciating. For the anti-fiat yellow metal, this presents conflicting fundamental forces. XAU/USD tends to have more momentum when both Treasury rates and the US Dollar are moving in the same direction.

The yellow metal will be turning its attention to the next US CPI print in the week ahead. The headline rate is anticipated at 5.8% y/y in October versus 5.4% prior as core growth clocks in at 4.3% y/y against 4.0% prior. Coupled with rising average hourly earnings, the data will likely show that inflation remains above the central bank’s target.

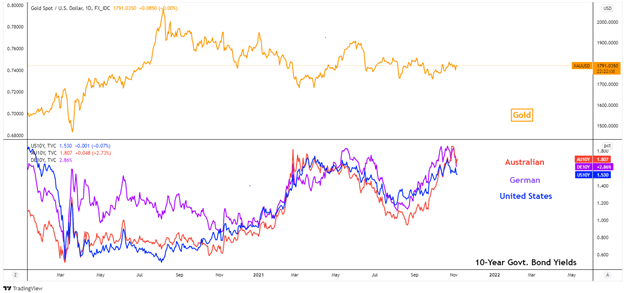

Still, it will probably continue taking persistent readings above target to shift the central bank’s tone on raising interest rates as well as the eventual shrinking of its balance sheet. This may be reinforced by a plethora of Fedspeak this week, including from Chair Jerome Powell. Elevated global bond yields will likely continue weighing against the precious metal – see chart below. This may keep XAU/USD range-bound.

Check out the DailyFX Economic Calendar to see when Fed policymakers will be speaking this coming week!

Gold Vs. 10-Year Government Bond Yields

--- Written by Daniel Dubrovsky, Strategist for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter

Trade Smarter - Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team