Gold Fundamental Outlook: Neutral

- Gold prices may continue struggling in range trade

- Rosy US data could sink USD, but boost bond yields

- Key risk for XAU/USD is S&P 500, Dow Jones drop

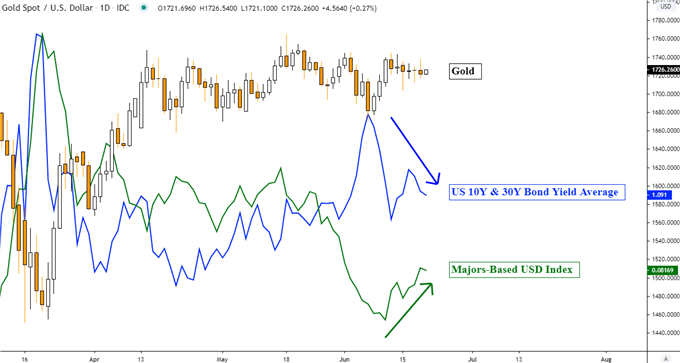

At the end of May, I highlighted that gold prices were struggling to gain further upside momentum since XAU/USD bottomed in late Match. Since then, the anti-fiat yellow metal has remained largely in directionless trade. The fundamental forces driving bullion are a careful balance between the direction of the US Dollar and Treasury yields. This narrative has not materially changed since.

In recent days, the haven-linked USD has been gaining lost ground as the S&P 500, Dow Jones and Nasdaq Composite wandered off their uptrends after this month’s Federal Reserve rate decision. A combination of cautious commentary from Chair Jerome Powell about the economic outlook and rising cases of the coronavirus spooked markets. This also resulted in yields on longer-dated Treasuries pulling back – see chart.

In an environment where the US Dollar is rising and local bond yields are falling, gold can struggle to find direction in the near term. Down the road however, depressed borrowing costs, as central banks refrain from raising rates too soon, can work in XAU/USD’s favor. Still, the risk for the yellow metal remains a swift resurgence in volatility that boosts demand for liquidity, as with what happened during the Covid-19 outbreak.

Discover your trading personality to help find forms of analyzing financial markets

Gold Fundamental Drivers – Daily Chart

Gold Chart Created in TradingView

*Majors-based USD index averages it against: EUR, JPY, GBP and AUD

Economic Event Risk – Second Coronavirus Wave, US Data, IMF

With that in mind, what are some risks in store ahead? As mentioned earlier, virus cases have been rising with hotspots seen in China’s capital, Beijing, Brazil, India and also the United States. If governments reverse course on lockdown easing to protect their citizens, that would almost certainly prolong what is expected to be the world’s largest contraction in GDP since World War 2 – according to the World Bank.

If this induces sharp selling pressure in equities, raising the premium for liquidity, then gold may reverse course. Focusing on US data, Markit PMI (services & manufacturing), durable goods orders, personal spending and University of Michigan Sentiment are due throughout the week. Data has been tending to materially outperform relative to economists’ expectations, opening the door to further upside surprises.

If stocks rise on a slew of rosy US data, the haven USD could fall as demand for safety weakens. But, this may also raise yields on longer-dated Treasuries. As such, these two forces working in tandem could leave the yellow metal struggling to find direction once more. Meanwhile, growth in the Fed’s balance continues to slow. In fact, it shrank over 1% last week.

This could mean that the extraordinary amount of liquidity deployed during the peak of the coronavirus outbreak is fading. For global equities, that could mean an increasingly challenging path to new highs. Or in other words, diminishing the scope for more USD weakness (gold negative). The International Monetary Fund is going to update 2020 growth prospects ahead and those may paint a still-dismal picture.

Absent a shock that sinks equities, it seems that gold prices could continue to struggle in directionless trade. As such, this makes for another neutral call for the fundamental outlook.

--- Written by Daniel Dubrovsky, Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter