Gold trades at its highest level since 2013, with the price for bullion climbing to a fresh yearly-high ($1557) in September.

In turn, the precious metal may exhibit a bullish behavior over the remainder of 2019 as market participants hedge against fiat-currencies.

The weakening outlook for global growth have pushed major central banks to shift gears this year, and the Federal Reserve may continue to alter the course for monetary policy as the US-China trade war drags on the economy.

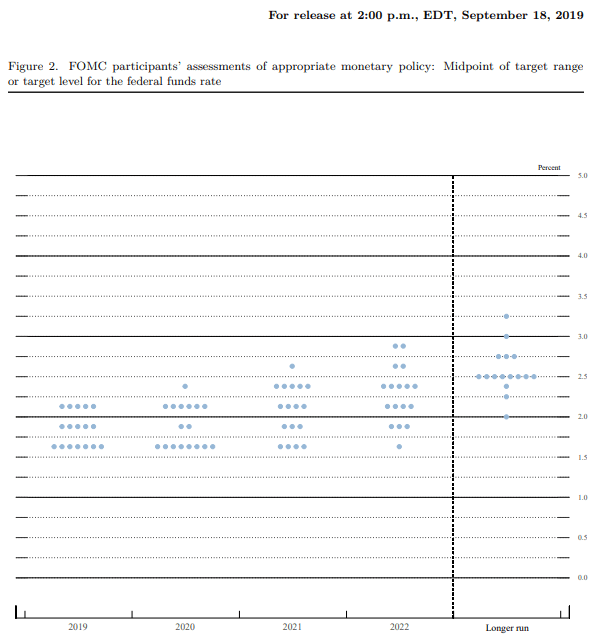

The fresh updates coming out of the Federal Reserve suggest the central bank will continue to insulate the economy as a number of Fed officials see the benchmark interest rate around 1.50% to 1.75% ahead of 2020.

It seems as though the Federal Open Market Committee (FOMC) will keep the door open to implement lower borrowing costs as the central bank pledges to “act as appropriate to sustain the expansion.”

However, a larger dissent may materialize within the FOMC as St. Louis Fed President James Bullard favored a 50bp rate cut in September, while Kansas City Fed President Esther George and Boston Fed President Eric Rosengren voted to keep the benchmark interest rate on hold.

A greater divide at the Fed may push market participants to hedge against fiat-currencies, and the price of gold may exhibit a more bullish behavior over the remainder of the year on the back of falling interest rates along with the inverting US yield curve.