Gold Price Talking Points

Fresh comments from a slew of Federal Reserve officials may influence the price of gold as there appears to be a growing dissent at the central bank.

Fundamental Forecast for Gold: Neutral

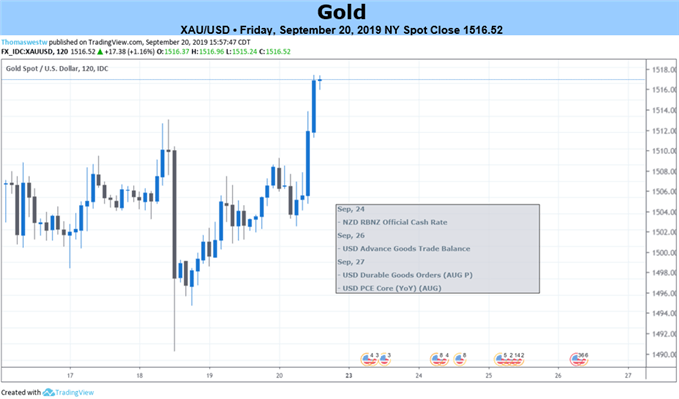

The price of gold slipped to a fresh monthly-low ($1483) as the Federal Open Market Committee (FOMC) took steps to “help keep the U.S. economy strong,” and it seems as though the central bank will revert to a wait-and-see approach at its next interest rate decision on October 30 after providing “insurance against ongoing risks.”

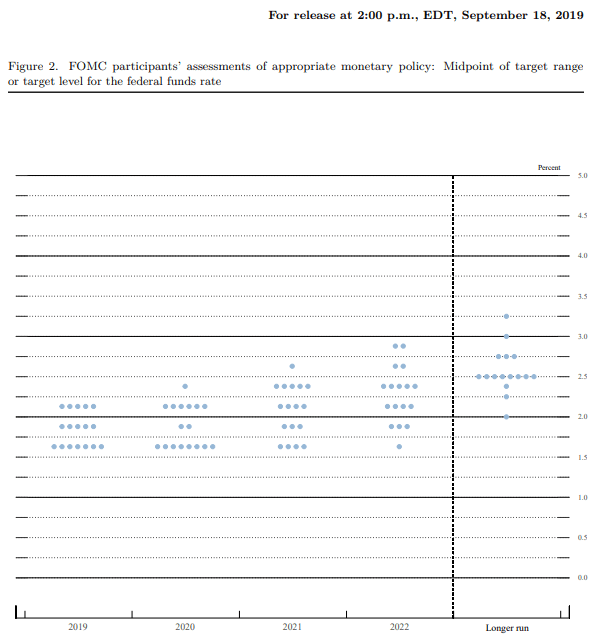

The minor adjustments to the Summary of Economic Projections (SEP) suggest the central bank is in no rush to reverse the four rate hikes from 2018 as Fed officials see the benchmark interest rate around 1.50% to 1.75% over the policy horizon, and the FOMC may stick to the sidelines over the remainder of the year as Chairman Jerome Powell anticipates the US economy to “expand at a moderate rate.”

However, there appears to be a growing rift within the FOMC as three voting-members dissent against the recent action, and the divide may ultimately heighten the appeal of gold as it raises the risk for a policy error.

In turn, market participants may pay increased attention to the slew of fresh remarks from the 2019-voting members as New York Fed President John Williams, St. Louis Fed President James Bullard, Chicago Fed President Charles Evans, Kansas City Fed President Esther George, Governor Richard Clarida and Governor Randal Quarles are all scheduled to speak over the coming days.

A batch of mixed rhetoric may push market participants to hedge against fiat currencies especially as President Donald Trump tweets “Jay Powell and the Federal Reserve fail again,” and falling interest rates along with the inverting US yield curve may keep gold prices afloat amid the threat of a policy error.

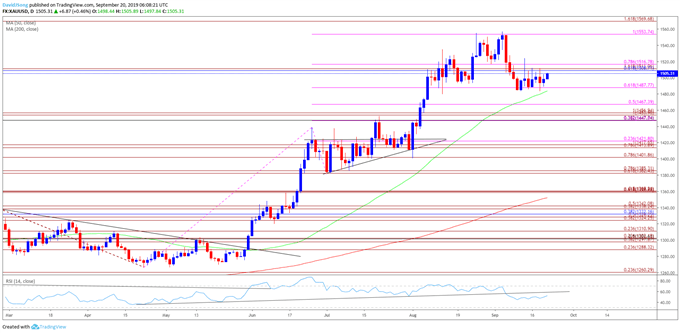

Gold Price Daily Chart

Source: Trading View

Keep in mind, the broader outlook for gold prices remain constructive as both price and the Relative Strength Index (RSI) clear the bearish trends from earlier this year.

Moreover, gold has broken out of a near-term holding pattern following the failed attempt to close below the $1402 (78.6% expansion) region, with gold prices trading to a fresh yearly-high ($1557) in September.

However, recent developments in the RSI warns of a near-term correction as the oscillator fails to preserve the upward trend carried over from April.

In turn, the failed attempt to close above $1554 (100% expansion) raises the risk for a larger pullback, with the monthly range on the radar amid the lack of momentum to hold above the $1509 (61.8% retracement) to $1517 (78.6% expansion) region.

Another close below $1488 (61.8% expansion) may spur a more meaningful run at $1467 (50% expansion), with the next area of interest coming in around $1447 (38.2% expansion) to $1457 (100% expansion).

Additional Trading Resources

For more in-depth analysis, check out the 3Q 2019 Forecast for Gold

Are you looking to improve your trading approach? Review the ‘Traits of a Successful Trader’ series on how to effectively use leverage along with other best practices that any trader can follow.

Want to know what other currency pairs the DailyFX team is watching? Download and review the Top Trading Opportunities for 2019.

--- Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong.