GOLD FUNDAMENTAL FORECAST: BEARISH

- Gold prices have climbed over 11 percent in the past two months on dovish Fed bets

- The FOMC rate decision may catalyze a reversal if dovish expectations are not met

- IMF publication of updated world economic outlook supports loose credit paradigm

See our free guide to learn how to use economic news in your trading strategy !

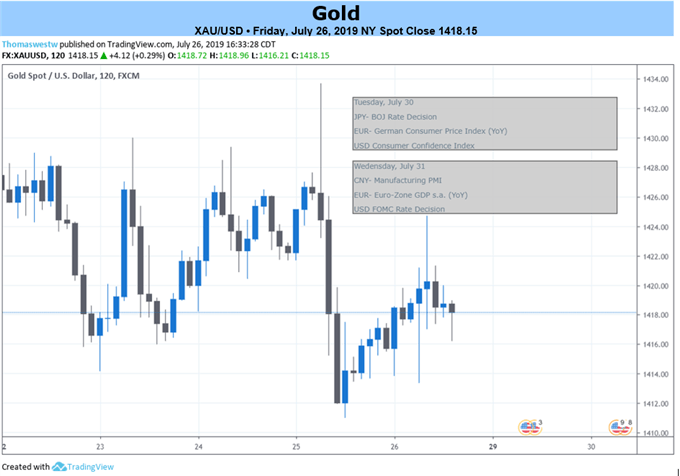

Gold prices will have tunnel vision this week as their biggest concern will be the FOMC rate decision and commentary. The yellow metal’s over 11 percent rise during the past 2 months may look increasingly overpriced if the central bank fails to meet or exceed the market’s comparatively more dovish expectations. Overnight index swaps are pricing in two rate cuts by the September meeting with odds of a third by year-end.

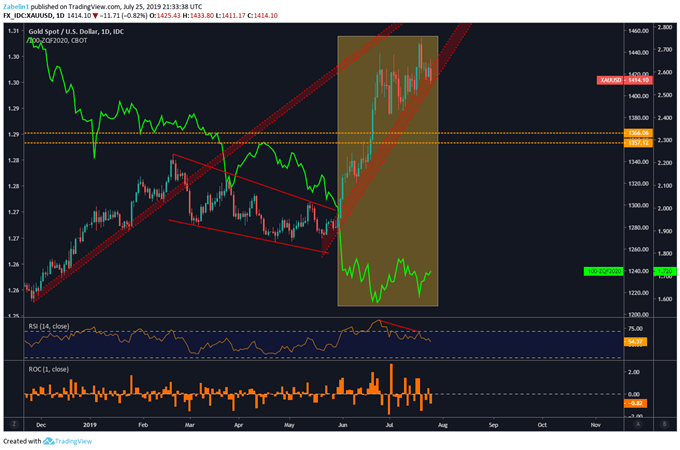

If the Fed fails to live up to market expectations – even if they announce a rate cut but have a less-dovish outlook– investors may perceive the Fed’s action and commentary as relatively more hawkish. Gold’s appeal as a non-interest-bearing asset may then erode and cause capital to shift from the yellow metal to the US Dollar, as opposed to what we have been seeing since December on the chart below.

Gold Prices Sharply Rose After Federal Funds Futures Took a Hit

Relative to 2018, the Fed’s dovish pivot has not been without reason. Economic data out of the US has been tending to underperform relative to economists’ estimates and the trade war has negatively impacted producer sentiment. The IMF’s recent publication of its updated world economic outlook strengthened the case for central banks adopting accommodative monetary policy.

GOLD TRADING RESOURCES

- Join a free Q&A webinar and have your trading questions answered

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

--- Written by Dimitri Zabelin, Jr Currency Analyst for DailyFX.com

To contact Dimitri, use the comments section below or @ZabelinDimitri on Twitter