Gold Price Talking Points

Fresh data prints coming out of the US economy may do little to curb the near-term advance in the price of gold as the Federal Reserve appears to be on a preset course to reduce the benchmark interest rate.

Fundamental Forecast for Gold: Bullish

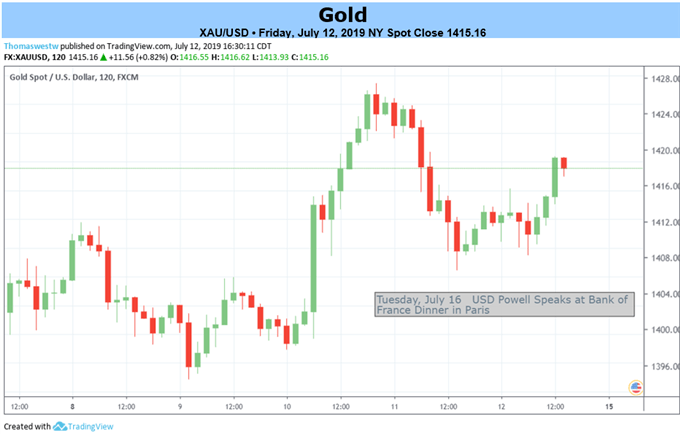

Gold prices look poised to test the 2019-high ($1439) following the semi-annual testimony with Federal Reserve Chairman Jerome Powell prepares US lawmakers for an imminent shift in monetary policy.

The prepared remarks suggest the Federal Open Market Committee (FOMC) will respond to the shift in trade policy as Chairman Powell warns that “uncertainties around trade tensions and concerns about the strength of the global economy continue to weigh on the U.S. economic outlook.”

Moreover, it seems as though the FOMC will continue to adjust the forward guidance over the coming months as President Donald Trump tweets “China is letting us down,” and the ongoing tensions may push the Fed to reverse the four rate hikes from 2018 as the “apparent progress on trade turned to greater uncertainty.”

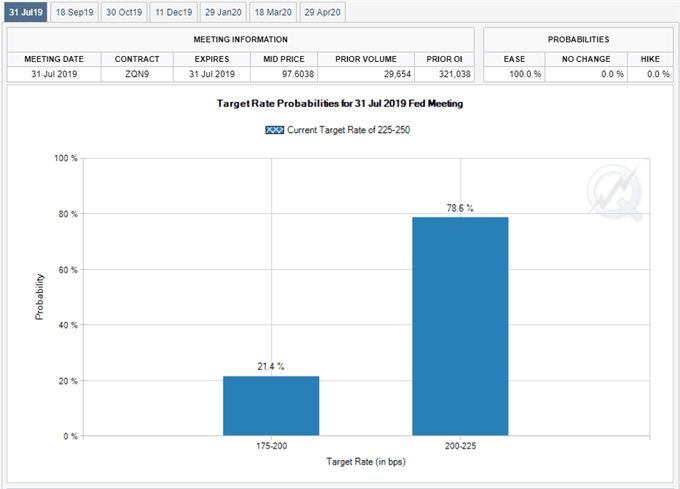

With that said, updates to the US Retail Sales report is likely to have a limited impact on the monetary policy outlook even though private sector spending is expected to increase 0.2% in June as Fed Fund futures continue to highlight a 100% probability for at least a 25bp rate cut on July 31.

It remains to be seen if the Federal Reserve will implement a rate easing cycle as St. Louis Fed President James Bullard, a 2019-voting member on the FOMC, endorses an “insurance cut,” but the preset course for monetary policy may ultimately hinder the central bank’s flexibility as the US economy shows little signs of a looming recession.

In turn, gold prices may continue to benefit from the current environment amid the threat of a policy error, and the price of bullion may exhibit a more bullish behavior over the remainder of the year as market participants look for an alternative to fiat currencies.

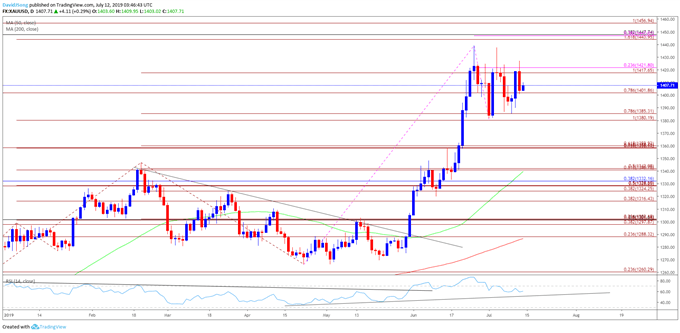

Gold Price Daily Chart

The broader outlook for gold is no longer mired by a head-and-shoulders formation as both price and the Relative Strength Index (RSI) break out of the bearish trends from earlier this year.

At the same time, the recent pullback in bullion appears to have run its course as the Fibonacci overlap around $1380 (100% expansion) to $1385 (78.6% expansion) offers support but need a move back above the $1418 (100% expansion) to $1422 (23.6% expansion) region to bring the topside targets back on the radar.

First area of interest comes in around $1444 (161.8% expansion) to $1448 (38.2% retracement) followed by the $1457 (100% expansion) region.

Additional Trading Resources

For more in-depth analysis, check out the 3Q 2019 Forecast for Gold

Are you looking to improve your trading approach? Review the ‘Traits of a Successful Trader’ series on how to effectively use leverage along with other best practices that any trader can follow.

Want to know what other currency pairs the DailyFX team is watching? Download and review the Top Trading Opportunities for 2019

--- Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong.