The adjustments in the Fed’s Summary of Economic Projections (SEP) suggest the central bank will continue to change its tune over the coming months as officials trim the growth and inflation forecast for 2019 and 2020. In turn, Chairman Jerome Powell and co. are now projecting a longer-run interest rate of 2.50% to 2.75%, and the change in the forwardguidance indicates that the central bank is on course to conclude the hiking-cycle ahead of schedule as ‘data arriving since September suggest that growth is slowing somewhat more than expected.’

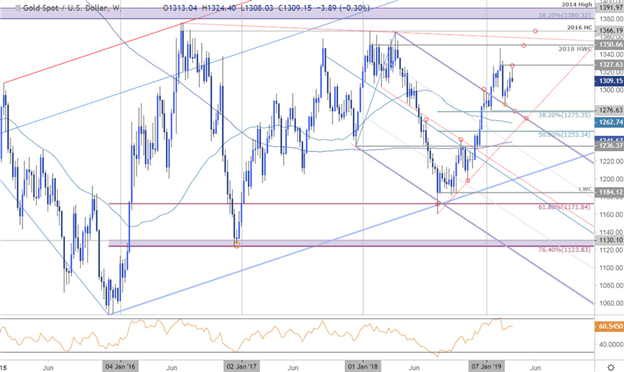

SPOT GOLD (XAUUSD) PRICE CHART: WEEKLY TIME FRAME

In turn, the current environment may continue to heighten the appeal of gold amid the upcoming changes in Fed policy. The price for bullion may exhibit a more bullish behavior over the coming months as the FOMC abandons hawkish forward guidance for monetary policy.

---Written by David Song and Michael Boutros, Currency Strategists