Fundamental Forecast for Gold:Neutral

- Gold prices fall back towards monthly lows, shorts at risk into FOMC

- What’s driving gold prices? Review DailyFX’s 4Q Gold Projections

- Join Michael for Live Weekly Strategy Webinars on Mondays at 12:30GMT

Gold prices are down for the second consecutive week with the precious metal off by .75% to trade at 1270 ahead of the New York close on Friday. The losses come amid continued strength in the U.S. Dollar with the DXY up more than 1.1% this week. Fueling the gains in the greenback was a sharp sell-off in the Euro after a dovish ECB President Mario Draghi suggested that interest rates would likely remain at present levels for "an extended period of time" after the QE program ends.

Heading into next week, all eyes fall on the Fed with the FOMC rate decision slated for Wednesday. While no change to the benchmark rate is expected, traders will be looking for any changes to the accompanying statement- specifically as it pertains to the inflationary outlook. Keep in mind markets have largely priced in a December hike with Fed Fund Futures currently showing an 87.1% probability for an increase of 25bps. However with both 3Q GDP and the Core Personal Consumption Expenditure (PCE) coming in stronger-than-expected on Friday, the question now becomes the future pace of subsequent rate-hikes.

For gold, prices are treading into murky territory and while some downside pressure may still be on the cards near-term, the decline starts to look vulnerable heading into next week. On whole, price have continued to trade within the confines of the monthly opening range and we’ll be looking for next week’s event risk to fuel a break.

New to Trading? Get started with this Free Beginners Guide

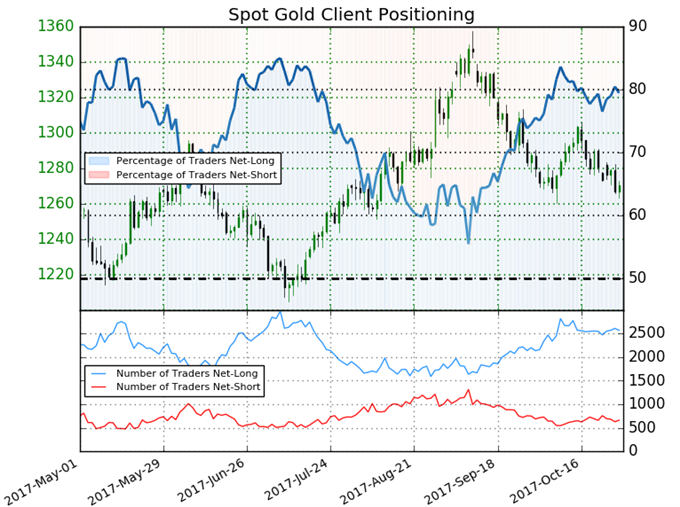

- A summary of IG Client Sentiment shows traders are net-long Gold - the ratio stands at +3.87 (79.5% of traders are long)- bearishreading

- Long positions are 2.2% lower than yesterday and 1.1% lower from last week

- Short positions are 1.9% lower than yesterday and 8.8% lower from last week

- We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests Spot Gold prices may continue to fall. Yet traders are less net-long than yesterday but more net-long from last week and the combination of current positioning and recent changes gives us a further mixed Spot Gold trading bias from a sentiment standpoint.

Learn how to use Gold sentiment in your trading. Get more information on Sentiment here Free !

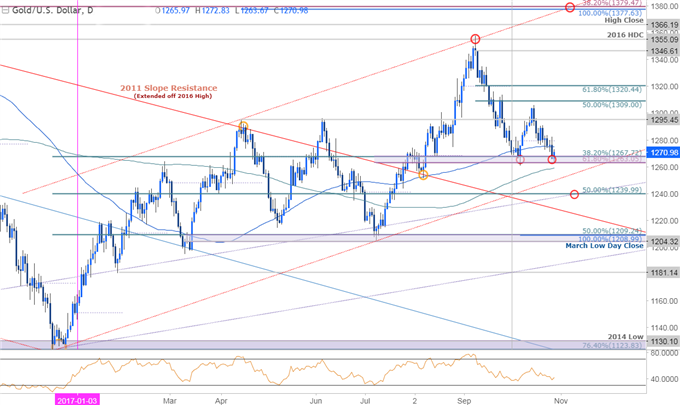

Gold Daily

Prices dropped into confluence Fibonacci support again this week at 1263/67. Note that the objective monthly opening range rests just lower and is backed by the 200-day moving average at 1259. A break below this threshold would shift the focus towards confluence support down at 1240.

Join Michael for his bi-weekly Live Webinar on the Foundations of Technical Analysis- Register for Free Here!

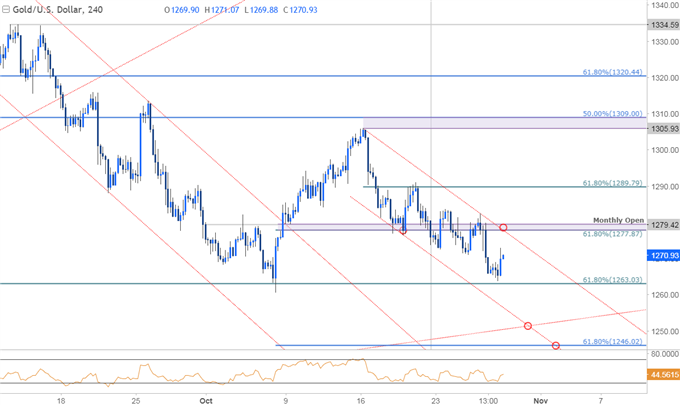

Gold 240min

We’ve had to continually adjust this slope and while we can’t rely on it yet too heavily, the upper does once again highlight the 1278/79 zone for near-term resistance. Ultimately a breach above 1290 would be needed to shift the focus back to the long-side targeting a breach above the monthly opening-range high / 50% retracement at 1306/09.

Bottom line: from a trading standpoint I’ll be looking for prices to stabilize above this level to suggest a more significant low is in place. A daily close below would risk a drop into subsequent support targets- such a scenario would have me looking for exhaustion / long-entries on a move into confluence support zones at 1250 & 1246.

What are the traits of a Successful Trader? Find out with our Free eBook !

---Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michaelon Twitter @MBForex contact him at mboutros@dailyfx.com or Click Here to be added to his email distribution list.