Fundamental Forecast for Gold:Bullish

- Gold Recovery Stalls, SPX 500 Treading Water Above March Low

- Gold Hits the Slopes

- Sign up for DailyFX on Demand For Real-Time Gold Updates/Analysis Throughout the Week

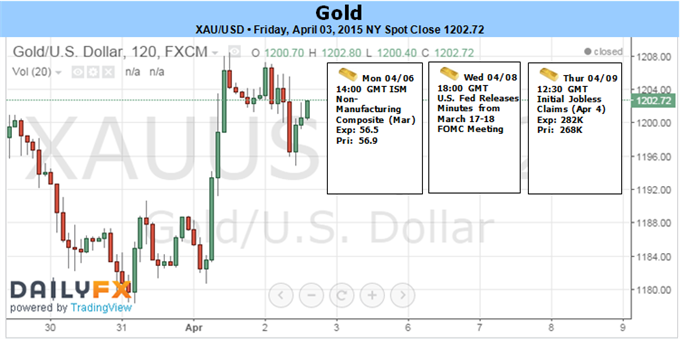

Gold prices are higher for a third consecutive week with the precious metal advancing nearly 0.4% to trade at 1202 into the close. The rally comes on the back of weakness in the USD with a dismal US employment report on Friday fueling a sell-off in the greenback into the close of the week. Although near-term price action is clouded heading into an extended holiday weekend, the broader outlook remains constructive while within the confines of a near-term technical formation with price action in the Dow Jones FXCM U.S. Dollar Index (Tickers: USDOLLAR) also in focus next week.

The US Non-Farm Payrolls (NFP) release on Friday came amid thin liquidity conditions with global markets (save Japan) closed in observance of Good Friday. A print of 126K jobs added last month missed consensus estimates for a read of 135K with the headline unemployment rate holding steady at 5.5%. Despite an unexpected uptick in wage growth, the ongoing deterioration in labor force participation along with the recent batch of weaker-than-expected U.S. data may fuel further dissent within the committee and drag on interest rate expectations. As such, narrowing bets for a mid-2015 rate hike may undermine the bullish sentiment surrounding the dollar and heighten the appeal of bullion as the slowing recovery raises the Fed’s scope to retain the highly accommodative policy stance for an extended period of time.

Last week we noted that gold was, “vulnerable for a pullback early next week but the bias remains constructive while above the 1167/72 barrier where the 61.8% retracement of the advance converges with a former resistance line off the 2015 high (bullish invalidation).” A pullback early in the week extended as low as 1178 before reversing sharply back through the 1196 inflection barrier we’ve been tracking for the past month (now near-term support).

The technicals get a little murky here after such an extended rally & until full market participation returns on Tuesday, we’ll remain neutral here while noting a general topside bias while within the confines of an ascending median-line formation. Expect price action to spend some time in this range with support & bullish-invalidation now raised to this week’s low. Initial Resistance is eyed at a longer dated median-line, currently around 1215 backed by 1223/25 & key resistance at 1245/48. A break of the lows targets the 1167 support barrier with subsequent objectives seen at 1150/51 & 1141/42. Bottom line: waiting for market conditions to normalize into next week with our outlook weighted to the topside while above 1180.