Fundamental Forecast for Gold:Neutral

- Gold Stalls at Technical Resistance- Remains Constructive Above 1262

- Gold Target is Still 1345

- Sign up for DailyFX on Demand For Real-Time Gold Updates/Analysis Throughout the Week

Gold prices are higher for a third consecutive week with the precious metal rallying 0.91% to trade at $1292 ahead of the New York close on Friday. Gold has remained well supported as concerns over a global economic slowdown and a flurry of unexpected central bank policy shifts saw inflows into the US Dollar and bullion. While the luster of gold seems to be gaining appeal, near-term the trade has come into a significant area of resistance ahead of major US metrics next week.

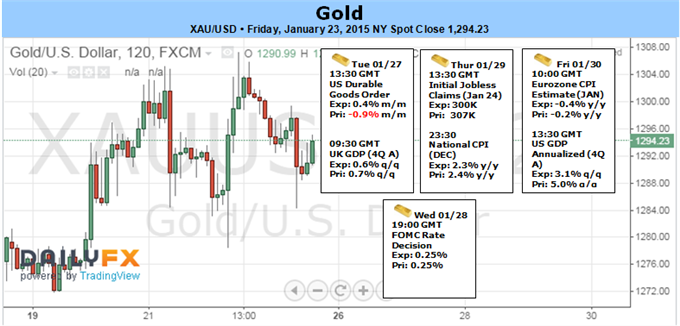

Given the slew of major surprises from global central banks, traders will be closely eyeing key US data prints next week with Durable Goods Orders, New Home Sales, Q4 GDP and the highly anticipated FOMC Interest Rate Decision on tap. Gold may continue to catch a bid in the coming days should the Federal Reserve interest rate decision further dampen the appeal of fiat currencies in light of the fresh wave of easing measures from SNB, ECB, and BoC. The high level of uncertainty surrounding the monetary policy outlook may continue to heighten the appeal of the bullion.

Despites expectations for a Fed rate hike in mid-2015, the new rotation within the voting committee may drag on interest rate expectations, especially as we lose the two hawkish dissenters from 2014 (Richard Fisher & Charles Plosser). As a result, the fresh vote count combined with a weakening outlook for global growth may undermine the bullish sentiment surround the greenback and boost demand for alternative stores of wealth should the FOMC talk down bets for a rate hike this year.

Last week we noted, “Look for a pullback early next week to offer favorable long-entries with the near-term outlook weighted to the topside while above $1248. A breach above resistance targets the 76.4% retracement of the July decline at $1294 and the upper median-line parallel of the November advance, currently just above the $1300-mark.” Gold remains within the confines of a well-defined ascending pitchfork formation off the November lows with this week’s rally coming into resistance at the upper median-line parallel, currently around $1307. Longs are at risk below this mark near-term with the broader bias remaining weighted to the topside while above $1263. Look for a pullback next week to offer favorable long entries with a breach of the highs targets resistance objectives at $1320/21, the July high-day close at $1335 and $1345.