US Dollar, Riots, Protests, ISM Data – Talking Points

- US Dollar may rise if ISM data underwhelms, sparks risk aversion

- Greenback gains may be amplified by liquidity demand amid riots

- NZD/USD may retest key uptrend as upside momentum slow down

Asia-Pacific Recap

Asia had a mixed start to the week. Initially, markets appeared to show a risk-off tilt as the anti-risk Japanese Yen and US Dollar rose at the expense of the growth-oriented Australian and New Zealand Dollars. US equity futures also pointed lower at the time. However, this dynamic later reversed and also saw the South Korean Won surge against its APAC peers.

US Dollar May Rise on ISM Data, Riots

The US Dollar may rise if data from the Institute of Supply Management (ISM) falls short of expectations and puts a premium on haven-linked assets. Manufacturing is anticipated to print a 43.7 figure, slightly higher than the prior 41.5 figure. The final reading for the analogous Markit PMI is expected to show a 40.0 statistic, slightly stronger than the previous 39.8 print.

However, what policymakers and market participants alike will likely be watching more closely are the large-scale riots occurring across various American cities. Businesses have been hit with reduced foot traffic and weaker consumption and may now also have to close their doors to avoid looting and vandalism. In Oakland, California, 70 businesses were looted on Saturday night.

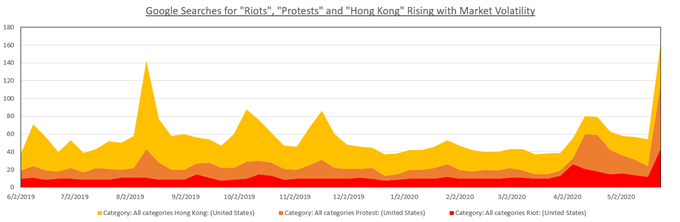

Google searches for “Riots” and “Protests” surged in recent days along with growing anxiety about what internal political debacle could mean for growth that is already under severe strain. “Hong Kong” is another term that is again resurfacing in total search volume in light of tension between the US and China over the former British colony. Learn more about the market implications here.

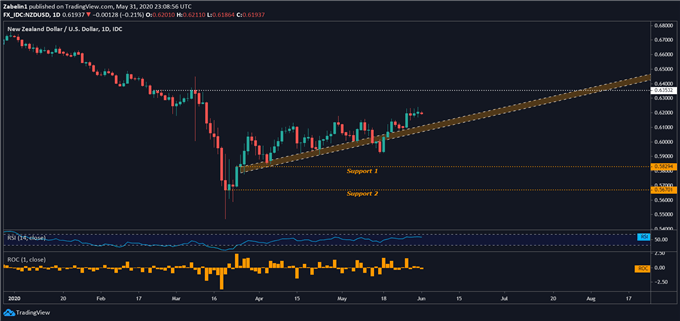

NZD/USD is shyly approaching familiar resistance at 0. 6353 (white-dotted line) as the pair continues to climb along a multi-week uptrend. NZD/USD did briefly dip below in in the middle of last month but quickly recovered – an example of why confirmation can be crucial – and resumed its uptrend. Looking ahead, if the slope of appreciation is invalidated, a short-term pullback of notable magnitude may ensue.

NZD/USD – Daily Chart

NZD/USD chart created using TradingView

--- Written by Dimitri Zabelin, Currency Analyst for DailyFX.com

To contact Dimitri, use the comments section below or @ZabelinDimitri on Twitter