US Dollar, Euro, British Pound, Australian Dollar – TALKING POINTS

- British Pound may suffer as Brexit talks stall ahead of a key deadline

- Euro could fall on Italian protests but nurse losses on political unity

- USD could rise vs AUD as US-China tensions over Hong Kong rise

GBP: Brexit Deliberations, Conflicting Lockdown Easing

The British Pound may fall as Brexit deliberations continue to drag the politically-sensitive GBP through the mud. This week, per the government’s authorization, lockdown measures will start easing as a reflection of Prime Minister Boris Johnson’s policy shift from “Stay at Home” to “Stay Alert”. Children are scheduled to be returning to primary school, though some lawmakers openly dissented against the easing measures.

Concern about internal fragmentation threw Sterling off-balance, but the primary political catalyst will likely continue to be Brexit. The government has made it clear that it does not intend on asking to extend the transition period beyond December 31 of this year. The ability to make such a request expires at the end of this month and there is little confidence an agreement can be made before the deadline.

Key policymakers on both sides have said that talks have not borne any fruit, making traders and policymakers alike fear that they must swallow the bitter and growing possibility of a no-deal Brexit. Stefaan de Rynck, senior advisor to Brexit chief negotiator Michel Barnier, said in an interview:

“I would be surprised if we get to an agreement by the end of June, but it is not excluded, but it is a tall order clearly because we are nearly June” – Stefaan de Rynck

If commentary of this tone continues to make the headlines, selling pressure in the British Pound will likely continue to build. Volatility may also rise as the timeline between now and June 30 narrows with policymakers still scrambling on how to handle the worst economic downturn since the Great Depression. The coronavirus pandemic continues to cloud the growth outlook for the UK with over 276,000 reported cases of Covid-19.

AUD & USD: China-US Tension Over Hong Kong Escalating

The cycle-sensitive Australian Dollar may fall versus its haven-linked US counterpart if relations between China and the US continue to deteriorate. The driving wedge between the two is a familiar topic: Hong Kong and its special status as an autonomous entity. Last week, China’s parliament overwhelmingly voted in favor of implementing new national security measures there following pro-democracy protests in 2019.

Shortly after, US President Donald Trump announced that the government was removing the autonomous state’s special status and revoking some of its economic privileges. He added that officials who “smothered” Hong Kong’s freedom would be sanctioned. After Beijing announced its new security measures, citizens in the former British colony began to protest again and were met with pepper pellets, tear gas and water cannons.

Last year these protests crushed tourism and consumption as businesses limited and/or shut down their operations. This caused Hong Kong to slip into a recession for the first time in a decade. With it now stuck in the middle of the US-China political tug of war, tension there could spill out and affect other areas of policy between the two economic powerhouses.

This in turn could accelerate selling pressure in the Australian Dollar, whose home country strongly relies on robust Chinese demand – particularly in hard commodities like iron ore. Conversely, the US Dollar in this environment may command a higher premium if prevailing market sentiment favors liquidity (Greenback) over returns (Aussie).

Furthermore, the anniversary of the 1989 Tiananmen Square protests will be marked – as per the annual custom in Hong Kong – by a vigil. However, the symbolism there could inspire even more dissent. It also may be happening on the same day that a controversial bill about criminalizing disrespect of China’s national anthem will be subject to additional scrutiny.

EUR: Italy Protests, Eurozone Political Jitters

This week, leader of the right-wing Lega Nord party Matteo Salvini will be leading protests in Rome against the government for its handling of the coronavirus pandemic and post-Covid-19 recovery policies. Political turbulence in Italy over the past two years has not only rocked sovereign bond markets in the South but also chipped away at the Euro. See my piece outlining how politics impacts markets here.

However, the recent Franco-German proposal of a 500 billion euro aid package helped to push yields on Italian debt lower and the politically-sensitive Euro higher. The policy calls for deeper economic integration and contains quasi-debt-mutualizing features to it that Mediterranean states have long been calling for. Having said that, the proposal will undergo negotiations, and uncertainty there could trim Euro gains.

EUR/GBP Technical Analysis

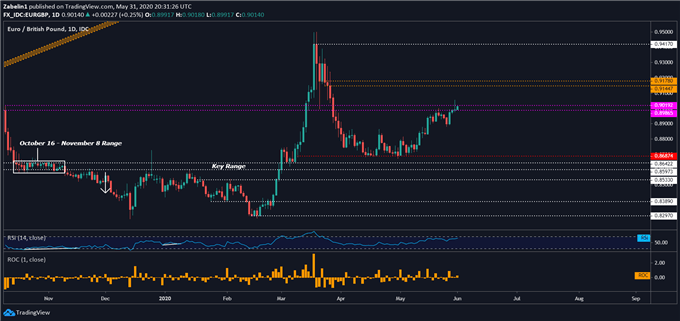

EUR/GBP is trading within the parameters of the 0.8986-0.9019 (purple-dotted lines) inflection area that could act as a key pressure point in the pair’s trajectory. A break above the upper tier with follow-through could open the door to retesting a resistance range between 0.9178 and 0.9144 (gold-dotted lines). The fundamental circumstances suggest a bullish bias towards the pair as Brexit talks weigh on the politically-sensitive GBP.

EUR/GBP – Daily Chart

EUR/GBP chart created using TradingView

--- Written by Dimitri Zabelin, Currency Analyst for DailyFX.com

To contact Dimitri, use the comments section below or @ZabelinDimitri Twitter