Eurozone Economy, US Dollar, Euro Outlook

- Euro may suffer if German factory orders data spooks markets

- Eurozone growth outlook remains shaky amid trade war risks

- German economic indicators are hovering at alarming levels

Learn how to use political-risk analysis in your trading strategy !

The Euro may fall vs the US Dollar if German factory orders data falls short of estimates and reinforces concerns about the Eurozone’s economic growth trajectory. As the largest economy in Europe, what happens in Germany is of great concern to the region. A slowdown in growth there could send a chilling wind throughout the continent and further pressure local growth against the backdrop of erratic Brexit updates.

Since June, economic data in the Eurozone has been tending to underperform relative to economists’ expectations according to the Citi Group Economic Surprise Index. It would therefore not be entirely surprising to see German factory data fall in line with this broader trend. The ongoing US-China trade war continues to undermine the region’s growth which is now being afflicted by a US economic conflict.

Recently, the WTO has awarded the US the right to slap over $7 billion worth of tariffs against the EU. Upon the news, European equity markets plunged against the backdrop of a possible retaliation by Europe. Washington also has not removed the possibility of imposing a tariff on auto imports which would be yet another headwind Europe would have to face.

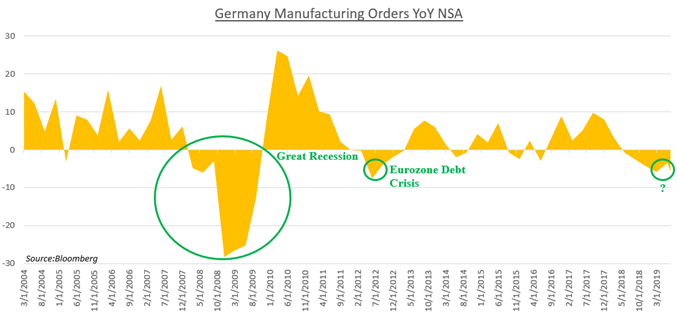

Were this to occur, Germany’s export-heavy equity DAX index would suffer as it struggles to reach its 2018 high at 13596. The country’s factory orders on a year-on-year basis (not seasonally adjusted) are expected to show a -6.4 percent reading, lower than the previous -5.6 percent print. Taking a 15-year perspective, the last time the reports were at these levels was during the Eurozone debt crisis, and before that the 2008 recession.

Chart of the Day: German Factory Orders Induce Chilling Premonitions

FX TRADING RESOURCES

- Join a free webinar and have your trading questions answered

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

--- Written by Dimitri Zabelin, Jr Currency Analyst for DailyFX.com

To contact Dimitri, use the comments section below or @ZabelinDimitri on Twitter

.jpg)