Swedish Krona, Euro, European Growth – TALKING POINTS

- Euro could suffer if Italian manufacturing data misses

- Sweden retail sales may increase growing rate cut bets

- Volatility could be tame as traders wait for GDP data

Learn how to use political-risk analysis in your trading strategy !

The Euro may fall if Italian manufacturing data falls short of estimates and further bolsters the case stimulus by the European Central Bank. The Swedish Krona may also suffer if retail sales data undershoots forecasts. Economic growth in the Nordic country is continuing to slow against the backdrop of waning demand out of a key importer of Swedish goods: Europe. Germany’s latest GDP reading is the latest sign of this trend.

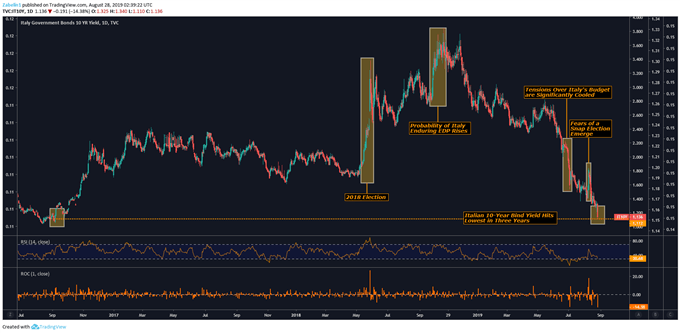

This comes against the backdrop of Italian political uncertainty in the third-largest Eurozone economy. The Five Star Movement (M5S) is currently negotiating with the Democratic Party (PD) to form a viable coalition in order to avoid the possibility of a Lega-Nord government headed by Matteo Salvini. Markets welcomed the news of a possible M5S-PD alliance with Italian bond yields sliding to their lowest point in three years.

Learn more about why investors are paying such close attention to Italian politics

In Sweden, local retail sales are expected to show 3.0 percent reading on a year-on-year basis. Quarterly, it is pegged at 0.3 percent, lower than the previous 1.0 percent print. Sweden’s outward-facing economy has been suffering from unstable geopolitical developments on the mainland against the backdrop of volatile US-China trade war developments. The cycle-sensitive SEK remains the worst-performing G10 currency this year.

However, volatility in both the Euro and Swedish Krona may be limited by traders who are waiting to commit capital only after the GDP data avalanche on Thursday. Growth reports out of the US and Euro Area will likely be the biggest points of focus. The latter in particular will garner a significant amount of attention because of how it may impact Fed monetary policy, especially after the Jackson Hole symposium last week.

CHART OF THE DAY: Impact of Italian Politics on Local Bond Yields

Italian bond yield chart created using TradingView

EUR, SEK TRADING RESOURCES

- Join a free webinar and have your trading questions answered

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

--- Written by Dimitri Zabelin, Jr Currency Analyst for DailyFX.com

To contact Dimitri, use the comments section below or @ZabelinDimitri on Twitter