TALKING POINTS – US GDP, DOLLAR, JAPANESE YEN

- Aussie, NZ Dollars correct higher after hitting four-month lows

- First-quarter US GDP data in focus, disappointment risk seen

- US Dollar may rise if soft growth drives haven-seeking demand

Currency markets appeared to be in corrective in Asia Pacific trade. The Australian and New Zealand Dollars narrowly outperformed, extending a recovery traced out over the prior session launched after hitting four-month lows. The recently buoyant US Dollar edged modestly lower.

The spotlight now turns to first-quarter US GDP data. It is expected to show that the annualized growth rate ticked up to 2.3 percent in the first three months of 2019, up from 2.2 percent previously. Recent US macro news-flow has mostly lagged relative to forecasts however, warning of incoming disappointment.

A downbeat print is likely to stoke fears about ongoing global slowdown, putting financial markets on the defensive. In the absence of meaningful Fed rate hike prospects, any further dovish in policy bets may be overshadowed by liquidity demand amid de-risking, boosting the Greenback.

The similarly anti-risk Japanese Yen may likewise benefit. It has tracked higher in what looks like pre-positioning for the Golden Week holiday lull. A US GDP print that encourages divestment from JPY-funding carry trades as investors reduce exposure to risky assets may see the rally gain momentum.

What are we trading? See the DailyFX team’s top trade ideas for 2019 and find out!

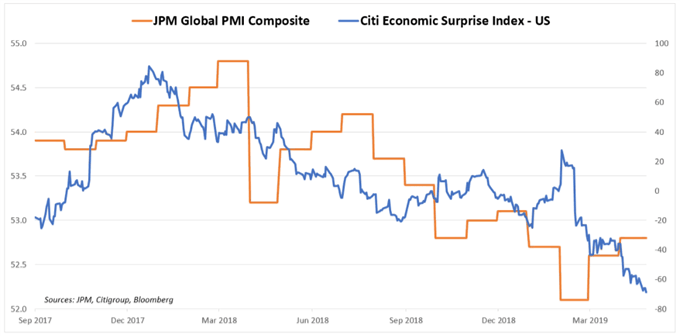

CHART OF THE DAY – US ECONOMIC DATA WEAKER AS GLOBAL GROWTH SLOWS

Citing the relative strength of the US economy has been commonplace among market-watches recently. While the performance of other pace-setting economies – notably the Eurozone and China – has been disappointing by comparison, the US seems far from immune amid the ongoing slowdown in global growth.

The chart shows the pace of worldwide manufacturing- and service-sector growth – as tracked by the JPMorgan Global PMI index – has been slowing since early 2018. Against this backdrop, US economic news-flow has increasingly deteriorated relative to analysts’ projections, according to data from Citigroup.

Put another way, economists producing forecasts for US data releases appear to envision far rosier conditions than reality has ratified. What’s more, deepening underperformance suggests optimism has been impervious to countervailing evidence so far, setting the stage for further downside surprises.

FX TRADING RESOURCES

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a free Q&A webinar and have your trading questions answered

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter