TALKING POINTS – YEN, BOJ, GOLDEN WEEK, ECB, DURABLES, EARNINGS

- Yen broadly higher despite mixed lead from equities in APAC trade

- Divestment before Golden Week holiday may be driving price moves

- Risk aversion may add to Yen gains. Key USD/JPY support sup-111

The Japanese Yen traded higher against all of its G10 FX counterparts despite mixed cues from Asia Pacific stock exchanges. Performance there often establishes a baseline for sentiment trends that typically drives the perennially anti-risk currency.

It is tempting to pin the rise on the Bank of Japan, which tweaked official guidance to say that the current ultra-accommodative setting will remain “at least” through next spring. That might’ve been interpreted as an awkward stimulus withdrawal signal. The Yen’s rise started hours prior however.

Divestment ahead of the upcoming Golden Week holiday lull in Japan seems like a more plausible explanation. Specifically, the unwinding of carry trade exposure – bets on relatively risky assets financed cheaply in JPY terms – might have singularly stoked demand for the go-to funding unit.

YEN MAY EXTEND RISE ON SOURING MARKET SENTIMENT

A further tailwind may emerge if a committed risk-off bias is established. Downbeat rhetoric warning of slowing global growth in the ECB Economic Bulletin may start this process. US durable goods orders data might help as well if the outcome echoes a recent tendency for results to undershoot forecasts.

The corporate earnings season seems likely to take top billing however. The busiest day on the docket this month will see 62 constituents of the pace-setting S&P 500 index release results. A few standouts aside, the overall tone has been downbeat. More of the same promises larger JPY gains.

What are we trading? See the DailyFX team’s top trade ideas for 2019 and find out!

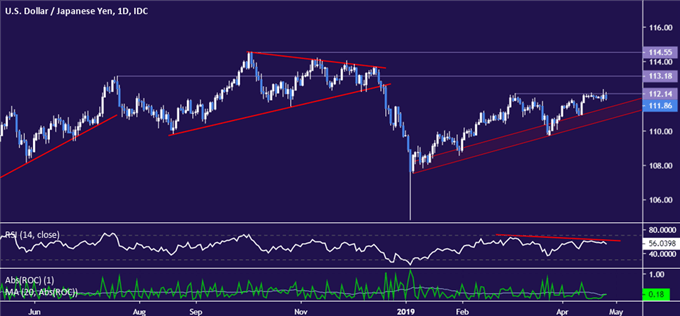

CHART OF THE DAY – USD/JPY CHART SETUP HINTS AT YEN GAINS AHEAD

USD/JPY technical positioning hints the US currency may be vulnerable to a downturn. Prices tellingly struggled with resistance at 112.14. Now, the appearance of negative RSI divergence marks ebbing upside momentum and bolsters the case for weakness. Confirmation of a deeper down move requires a daily close below rising trend line support set from January, now at 110.64.

FX TRADING RESOURCES

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a free Q&A webinar and have your trading questions answered

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter