GOLD & CRUDE OIL TALKING POINTS:

- Gold price rise capped as US Dollar gains amid risk aversion

- Crude oil prices stall at chart resistance, turn lower threatened

- First-quarter corporate earnings reports still in the spotlight

Gold prices edged up as risk appetite cooled on global financial markets, weighing down bond yields and thereby bolstering the appeal of non-interest-bearing alternatives. A move beyond the recent congestion range was not in the cards however. The US Dollar rose on the back of haven-seeking capital flows, capping gains for the anti-fiat yellow metal.

Crude oil prices edged lower, with downside pressure from the broadly risk-off mood compounded by EIA inventory flow data. It showed that stockpiles added a hefty 5.5 million barrels last week, dwarfing expectations for meager 810.7k barrel rise. The outcome echoed API data published Tuesday that called for a larger inflow.

COMMODITY PRICES FOCUSED ON CORPORATE EARNINGS DOCKET

Looking ahead, the ongoing publication of first-quarter corporate earnings reports takes top billing. An eye-watering 62 constituent firms making up the bellwether S&P 500 index are set to release results. The tone has been somewhat downbeat. Preliminary results are sobering. Corporates are on pace for the weakest performance in at least a year, with negative earnings growth expected for the first time in two years.

More of the same might amplify worries about the ongoing slowdown in global economic growth, inspiring renewed de-risking. That bodes ill for cycle-sensitive crude oil prices. As for gold it may find a bit of support as bond yields remain under pressure, but an offsetting rise in the Greenback is a likely headwind. In fact, the latter catalyst has proven to be a bit more potent than the former recently.

See the latest gold and crude oil forecasts to learn what will drive prices in the second quarter!

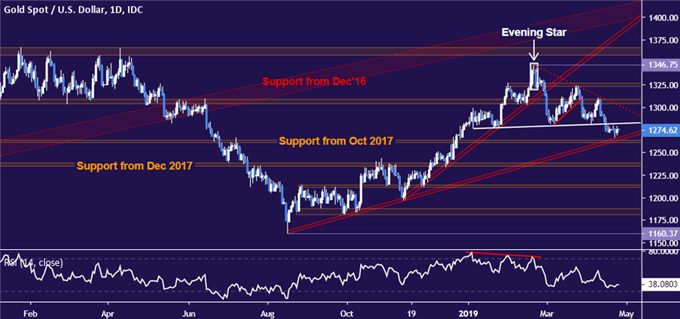

GOLD TECHNICAL ANALYSIS

Gold prices remain mired in digestion mode above supportin the 1260.80-63.76 area but the completion of a bearish Head and Shoulders (H&S) chart pattern argues for a major top in place. A break below the immediate downside barrier initially targets the 1235.11-38.00 zone but the H&S setup implies a measured objective at 1215.00. Alternatively, a move back above neckline support-turned-resistance at 1281.89 opens the door to test back above the $1300/oz figure.

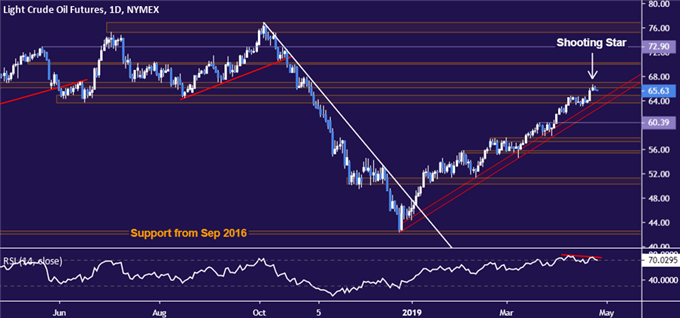

CRUDE OIL TECHNICAL ANALYSIS

Crude oil prices stalled after producing an admittedly awkward-looking Shooting Star candlestick below resistance in the 66.09-67.03 area. This coupled with negative RSI divergence hints a turn lower may be ahead. Trend line support is at 62.66, with a break below that confirmed on a daily closing basis initially exposing 60.39. Alternatively, a break above resistance sets the stage for a test of the $70/bbl figure.

COMMODITY TRADING RESOURCES

- See our guide to learn about the long-term forces driving crude oil prices

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a Trading Q&A webinar to answer your commodity market questions

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter