TALKING POINTS – BREXIT VOTE, US DURABLE GOODS, EURUSD

- How will EUR/USD react to US durable goods orders?

- Euro, Greenback eyeing upcoming no-deal Brexit vote

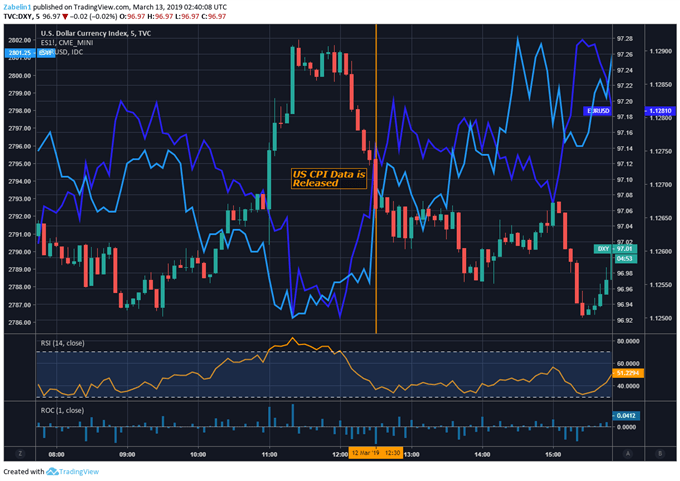

- DXY, dipped on US CPI while S&P500 futures jumped

See our free guide to learn how to use economic news in your trading strategy !

February’s US headline and core CPI undershot forecasts, subsequently sending the US Dollar-weighted index (DXY) lower while EUR/USD and S&P500 futures gained. US economic data has been broadly falling short of expectations according to the Citi Economic Surprise Index since February. This perhaps gave additional impetus for the Fed to continue to remain relatively neutral and be “patient” with raising rates.

In the UK, Prime Minister Theresa May’s Brexit deal was overwhelmingly defeated in parliament for a second time with 391 against and 242 in favor. Sterling currency crosses subsequently plunged. Later today, the House of Commons will vote on a no-deal Brexit which could open the door for a second referendum or even no Brexit. There is also the possibility of an extending article 50 but that may come at a price of 39 billion GBP.

However, before the vote begins, traders may keep a peripheral view on Eurozone industrial production with their main focus likely on preliminary US durable goods orders for January. Estimates for the latter are currently pegged at -0.40 percent with the previous at 1.20. Slower global growth from the US-China trade spat along with increasing risk out of Europe may continue to weigh on risk appetite and make consumers less optimistic.

CHART OF THE DAY: DXY, EUR/USD S&P500 FUTURES

FX TRADING RESOURCES

- Join a free Q&A webinar and have your trading questions answered

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

--- Written by Dimitri Zabelin, Jr Currency Analyst for DailyFX.com

To contact Dimitri, use the comments section below or @ZabelinDimitri on Twitter