TALKING POINTS – YEN, DAVOS, WORLD ECONOMIC FORUM, AUSTRALIAN DOLLAR

- Yen drops, commodity dollars rise as risk appetite firms in APAC trade

- Anxious commentary form Davos forum may trigger risk aversion anew

- S&P 500 futures erase early-Wed gains, bolstering case for risk-off bias

The anti-risk Japanese Yen traded broadly lower while the sentiment-geared Australian, Canadian and New Zealand Dollars rose in Asia Pacific trade. These moves appear to be corrective in the context of yesterday’s market-wide bloodletting. The Kiwi outperformed, receiving an added boost form better-than-expected inflation data.

The upbeat mood may prove to be short-lived. Anxious commentary emerging from the on-going World Economic Forum in Davos, Switzerland may trigger another rout as leading policymakers and financial market bigwigs opine on the many headwinds facing the global economy. These include the US-China trade war, accelerating quantitative tightening and wobbly politics in much of the G10.

Tellingly, bellwether S&P 500 futures have retreated to trade flat ahead of the opening bell in London having been up nearly 0.4 percent in APAC trade. That seems to reinforce the sense that de-risking remains the dominant trajectory for global markets, with the rosier dynamics recorded early Wednesday representing digestion rather than reversal.

See our market forecasts to learn what will drive currencies, commodities and stocks in Q1!

ASIA PACIFIC TRADING SESSION

EUROPEAN TRADING SESSION

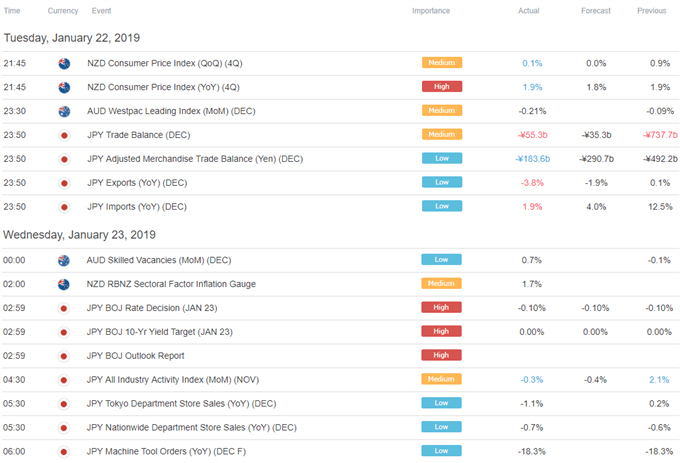

** All times listed in GMT. See the full economic calendar here.

FX TRADING RESOURCES

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a free Q&A webinar and have your trading questions answered

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter