TALKING POINTS – FED, BEIGE BOOK, US DOLLAR, BREXIT, BRITISH POUND

- US Dollar higher as hawkish Williams speech boosts Fed outlook

- Aussie Dollar underperforms in APAC trade after soft GDP data

- Pound may rise as Parliament humbles UK Prime Minister May

The US Dollar led the way higher in Asia Pacific trade, rising against all its major counterparts. Recovering Fed rate hike expectations seemed to be at work following a rosy speech form New York Fed President John Williams. He sang the economy’s praises and argued that gradual rate hikes will remain appropriate in the coming year or so. The Australian Dollar underperformed following disappointing GDP data.

Looking ahead, more of the same may be on offer as the Fed’s Beige Book survey of regional economic conditions comes across the wires. The US central bank’s recent pivot to a more data-dependent posture might imbue the release with greater market-moving potential. A broadly upbeat take on the economy may boost tightening bets further, helping the Greenback to recover further.

BRITISH POUND MAY RISE AS PARLIAMENT CHECKS PM MAY

Meanwhile, UK Prime Minister Theresa May seems to be on the defensive as her government spars with Parliament over control of the Brexit endgame. Ms May lost three critical votes back to back yesterday, forcing legal disclosure she was trying to avoid and signaling the mostly EU-friendly legislature may soften the UK’s divorce from the regional bloc after rejecting her proposal for its terms next week.

A softer Brexit – like an arrangement whereby the UK would stay within the EU single market – or a second referendum seeking to relitigate the outcome of the first one may boost the British Pound. Markets are understandably worried that opposition to Ms May’s deal-making will lead to a “hard” Brexit, disrupting economic activity. Anything that trims the risk of such an outcome is likely to be greeted warmly.

See our free guide to learn how to use economic news in your trading strategy !

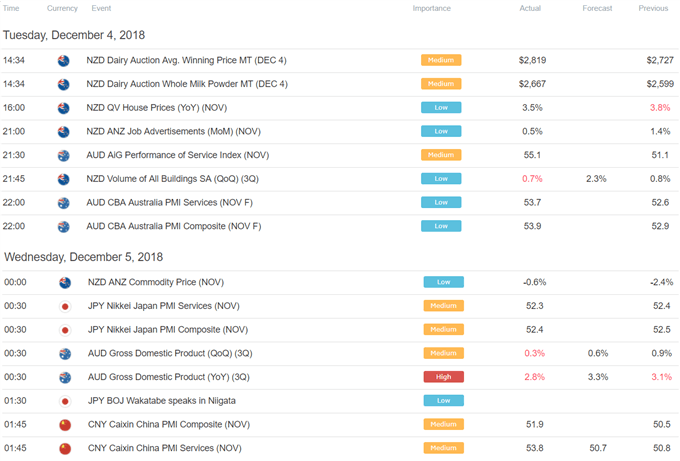

ASIA PACIFIC TRADING SESSION

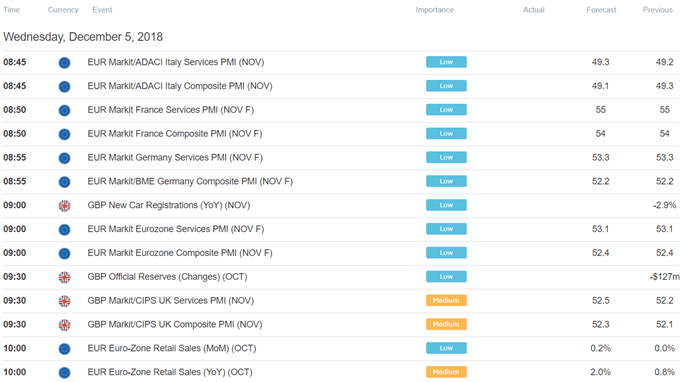

EUROPEAN TRADING SESSION

** All times listed in GMT. See the full economic calendar here.

FX TRADING RESOURCES

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a free Q&A webinar and have your trading questions answered

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter