TALKING POINTS – EURO, GERMAN CPI, US DOLLAR, FOMC MINUTES, FED

- Dovish shift in Fed rate hike expectations likely an overreaction

- FOMC minutes may revive tightening bets, boosting US Dollar

- Euro likely to overlook slight downtick in German CPI inflation

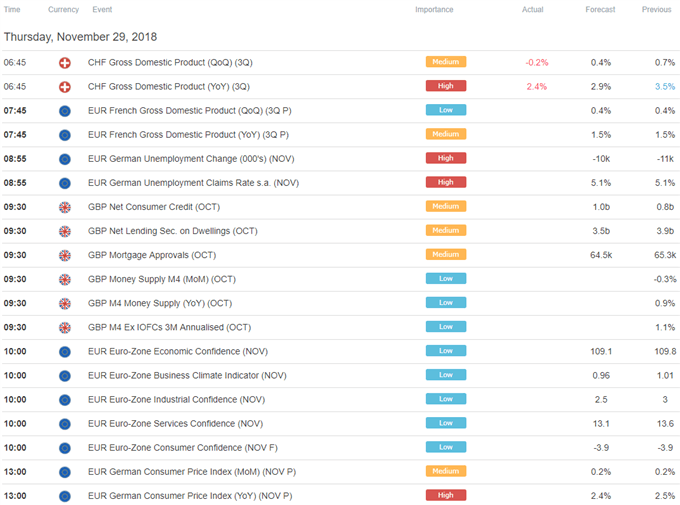

German CPI data headlines the economic calendar in European trading hours. The headline inflation rate is expected to edge down to 2.4 percent on-year in November, retreating from the decade high of 2.5 percent set in the prior month.

The outcome may mean little for the Euro one way or another considering its limited implications for near-term ECB monetary policy. The central looks to be on autopilot as it winds down QE through year-end and a subsequent rate hike is not expected at least through October of next year.

US DOLLAR MAY RISE ON FOMC MEETING MINUTES

That seems likely to put November FOMC meeting minutes squarely in the spotlight. The policy statement released following that gathering of the rate-setting committee struck an upbeat tone. A similar narrative in the today’s release may prompt a rethink of the latest dovish shift in market expectations.

Fed Chair Jerome Powell said the benchmark Fed Funds rate is now “just below” the neutral range, where policy is neither stimulative nor contractionary. Markets read that to mean that the current tightening cycle is nearing an end, slashing priced-in 2019 rate hike bets and sinking the US Dollar.

This seems like an overreaction. The Fed’s own estimates – last revised in late September – put the neutral rate in a range of 2.5-3.5 percent, with most policymakers’ bets clustered at the midline of this band at 3 percent. That is about 75-100bps away from the current 2-2.25 percent target Fed Funds rate range.

The Fed has also projected 75-100 basis points in hikes between now and the end of next year. In other words, Mr Powell’s remarks seem to endorse the status quo policy path unveiled two months. If the Minutes document implies as much, the Greenback is likely to stage a broad-based recovery.

See our free guide to learn how to use economic news in your trading strategy !

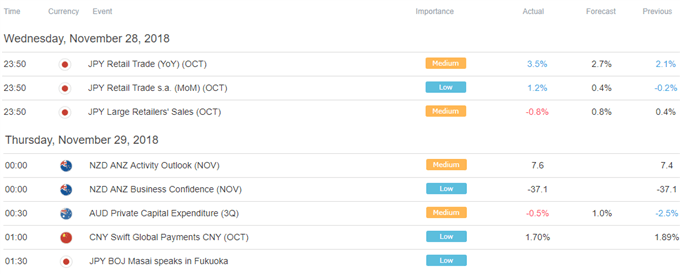

ASIA PACIFIC TRADING SESSION

EUROPEAN TRADING SESSION

** All times listed in GMT. See the full economic calendar here.

FX TRADING RESOURCES

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a free Q&A webinar and have your trading questions answered

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter