TALKING POINTS – US DOLLAR, EURO, ECB, FED

- US Dollar pullback continues, but may struggle for follow-through

- Comments from ECB officials may cool speculation on QE cutback

- Clarida, Bowman confirmation hearings to inform Fed policy bets

The US Dollar edged cautiously lower against its major counterparts, extending two days of corrective weakness after the benchmark currency hit a four-month high last week. The pullback appears to reflect digestion after an upshift in the expected Fed rate hike path drove an aggressive rally from mid-April lows.

A dull offering on the US calendar offers little to reignite momentum but downside follow-through may still stall as investors look on to a week of data points burnishing the Fed’s relatively hawkish credentials. News flow from Australia, Japan and the Eurozone is due to show tightening there remains far off.

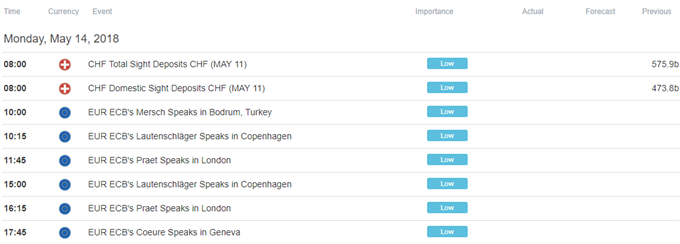

A taste of what this looks like could come courtesy of comments from ECB officials Monday. Rhetoric suggesting the central bank is skittish about dialing back QE – a sentiment likely to be echoed by President Draghi later in the week – may hurt the Euro and help the greenback by extension.

USD sellers may likewise struggle to sustain momentum as markets withhold further conviction before hearing what comes out of Senate confirmation hearings for Richard Clarida and Michelle Bowman. They are nominated to the Fed’s Vice Chair and community banking posts, respectively.

See our free guide to learn how to use economic news in your trading strategy !

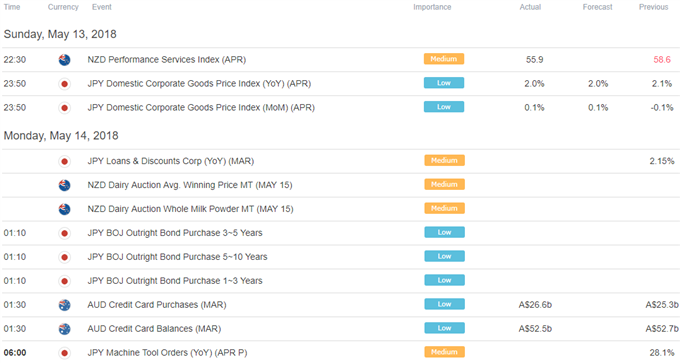

ASIA PACIFIC TRADING SESSION

EUROPEAN TRADING SESSION

** All times listed in GMT. See the full economic calendar here.

FX TRADING RESOURCES

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a free Q&A webinar and have your trading questions answered

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter