TALKING POINTS – EURO, ECB, DRAGHI, YEN

- Euro may fall as ECB’s Draghi talks down stimulus withdrawal bets

- Yen cautiously lower as Asia Pacific stocks follow Wall Street higher

- Slight miss on US CPI, Saudi oil minister’s comments lift sentiment

A speech form ECB President Mario Draghi headlines an otherwise bare calendar in European trading hours. He is due to appear speak at the EU State of the Union conference in Florence, Italy. The remarks might strike a cautious tone even as Mr Draghi talks up progress on economic recovery in the years following the global financial crisis and the follow-on Euro area sovereign debt debacle.

Economic data out of the currency bloc has soured relative to forecasts since the beginning of the year while Brexit negotiations remain a source of uncertainty. Progress on structural reforms that Mr Draghi has advocated for some years has also proved to be frustratingly slow. Taken together, the talk may reinforce the sense that the ECB is not ready to meaningfully dial down stimulus, weighing on the Euro.

The Japanese Yen narrowly underperformed in otherwise quiet Asia Pacific trade. The usually anti-risk currency declined as risk appetite brightened, with most regional shares following a positive lead from Wall Street upward. US shares rose for a sixth consecutive day, with the bellwether S&P 500 index breaking the series of lower highs established form late January.

Investors chipper mood seems to follow from slightly disappointing on April’s US CPI data and encouraging comments from Saudi oil minister Khalid Al-Falih. The inflation report showed core inflation missed analysts’ expectations with a print at 2.1 percent, cooling worries about an aggressive Fed rate hike cycle to some degree. Mr Al-Falih pledged oil price stability despite the likely re-imposition of sanctions on Iran.

Learn the #1 mistake that traders make and how to fix it with our free guide!

ASIA PACIFIC TRADING SESSION

EUROPEAN TRADING SESSION

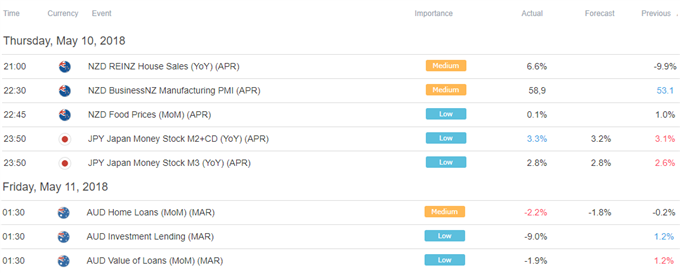

** All times listed in GMT. See the full economic calendar here.

FX TRADING RESOURCES

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a free Q&A webinar and have your trading questions answered

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter