Talking Points:

- Japanese Yen extends gains as risk aversion amplifies BOJ-inspired surge

- FTSE 100, S&P 500 futures warn against assuming anti-risk follow-through

- Lackluster data docket might make for elevated sensitivity to headline flow

The Japanese Yen led the way higher for a second day in Asia Pacific trade. The currency has been pushing higher since an unusually timid round of bond-buying from the Bank of Japan sparked speculation about stimulus withdrawal by stealth. A sour mood on local stock exchanges probably helped as well, amplifying the appeal of the perennially anti-risk currency.

Prospects for follow-through seem limited however. The BOJ’s “Yield Curve Control” (YCC) framework implies that the size of purchases will fluctuate depending on what it takes to bring bond rates to target. Sometimes that may translate into smaller uptake, but that doesn’t mean the broader policy stance is changing. Meanwhile, flat trade in FTSE 100 and S&P 500 futures argues against entrenched risk aversion ahead.

The day’s offering of European and US economic data is relatively timid, with no obviously potent catalysts on offer. On one hand, that might translate into a day of consolidation for the major currencies. On the other, it might make for elevated sensitivity to headline risk, hinting that a stray bit of news may spook otherwise sleepy markets and produce an outsized burst of knee-jerk volatility.

What is the #1 mistake that traders make, and how can you avoid it? Find out here !

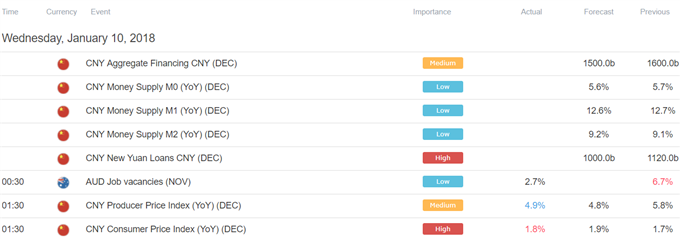

Asia Session

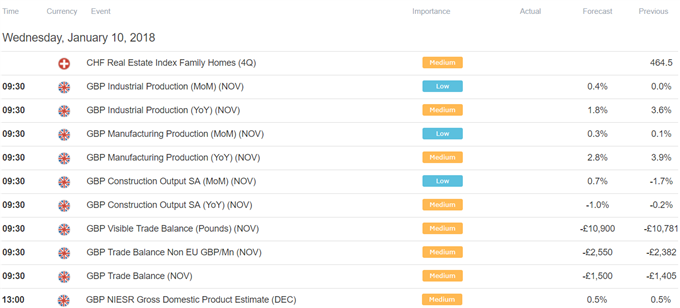

European Session

** All times listed in GMT. See the full DailyFX economic calendar here.

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To receive Ilya's analysis directly via email, please SIGN UP HERE

Contact and follow Ilya on Twitter: @IlyaSpivak