Talking Points:

- Euro may shrug off GDP and CPI data on stable ECB outlook

- Comments from UK Brexit Secretary Davis may sting the Pound

- Yen shrugs off dovish BOJ, NZ PM Ardern sinks Kiwi Dollar

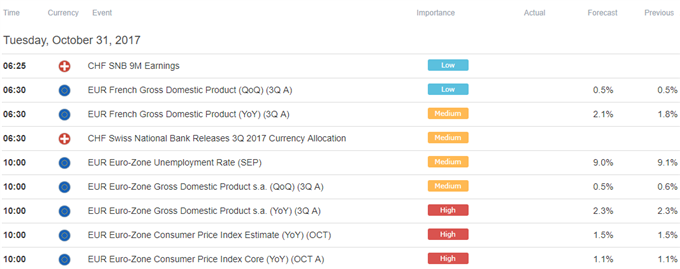

Eurozone GDP and CPI data headlines the data docket in European hours. Output is expected to have added 0.5 percent in the third quarter, marking a slight slowdown from the 0.6 percent gain in the prior three months. The headline on-year inflation rate is seen printing unchanged at 1.5 percent while the “core” reading excluding especially volatile items holds at 1.1 percent in October.

On balance, these results are unlikely a strong reaction from the Euro. The ECB has already established the near-term policy path with last week’s decision to extend QE asset purchases through September 2018 at a reduced rate of €30 billion/month. It would take a truly dramatic and sustained turn in economic data to push the central bank out of wait-and-see mode at this point.

Meanwhile, UK Brexit Secretary David Davis will face questioning in the House of Lords about the state of negotiations with his EU counterparts. Davis is a relative hard-liner within the May administration. If he uses this opportunity to push back demands of payment on prior UK commitments to the regional bloc as well the possibility of a transitional deal to follow the divorce, the British Pound may be pressured.

The anti-risk Yen rose as Japanese shares fell in Asia Pacific trade, shrugging off a slightly dovish Bank of Japan policy announcement. Governor Haruhiko Kuroda and company left the existing regime unchanged as broadly expected but lowered inflation expectations a bit, signaling that generous accommodation is here for the foreseeable future. BOJ newcomer Goushi Kataoka even pushed for stimulus expansion.

The New Zealand Dollar declined as newly minted Prime Minister Jacinda Ardern said foreign speculators will be banned from buying houses in the country starting early next year. Traders may have reasoned that easing upward pressure on real estate prices will bring down overall inflation, undermining prospects for an RBNZ interest rate hike for an extended period.

Have a question about trading the FX markets? Join a free Q&A webinar and ask it live!

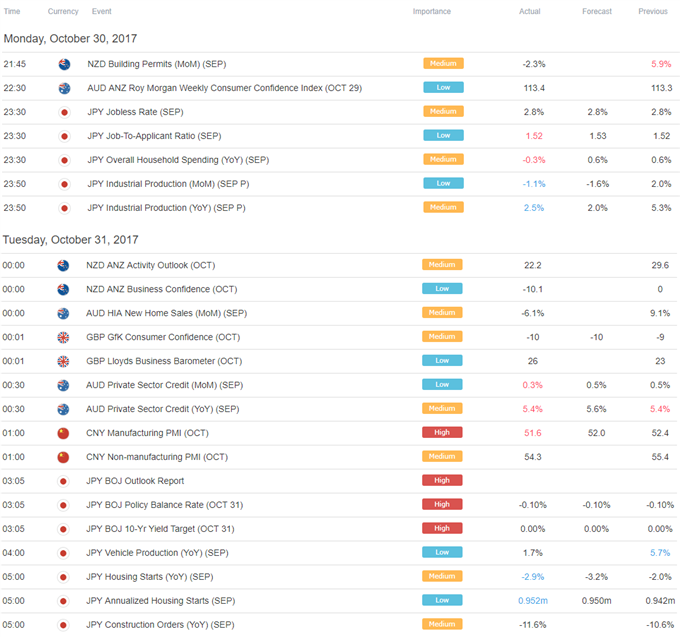

Asia Session

European Session

** All times listed in GMT. See the full DailyFX economic calendar here.

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To receive Ilya's analysis directly via email, please SIGN UP HERE

Contact and follow Ilya on Twitter: @IlyaSpivak