Talking Points:

- Euro at risk if German CPI disappoints, cools ECB tightening speculation

- US Dollar may rise as Q2 GDP rekindles 2017 Fed interest rate hike bets

- Are FX markets matching DailyFX forecasts so far in Q3? Find out here

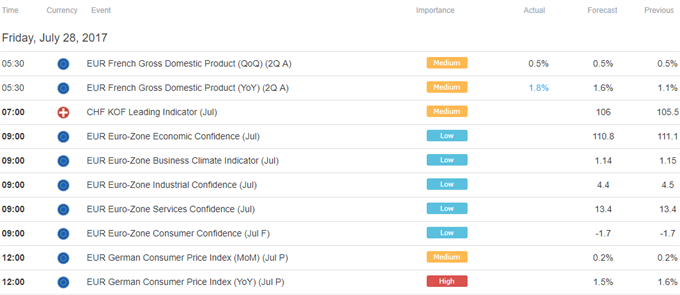

The preliminary set of July’s German CPI figures headlines the economic calendar in European hours. The headline year-on-year inflation rate is expected to tick down to 1.5 percent, revisiting the six-month low set in May. A weaker outcome echoing a sting of disappointing data in recent weeks may hurt the case for ECB stimulus reduction. That may weigh on the Euro, though it has been remarkably resilient lately.

The spotlight then turns to the second-quarter US GDP report. Consensus forecasts see the annualized growth rate accelerating to 2.7 percent from 1.4 percent in the three months through March. Unlike the Eurozone, recent US economic news-flow has increasingly improved relative to expectations. That may open the door for an upside surprise that rekindles bets on another Fed rate hike in 2017, boosting the US Dollar.

The Swiss Franc underperformed in overnight trade. The currency has been under pressure all week and is now working on its fifth consecutive daily drop, touching the lowest level since December 2015 against an average of its major counterparts. A clear-cut driver for the reversal is not readily apparent. Newswires have cited ECB tightening bets but evidence confirming as much is lacking.

The Japanese Yen traded broadly higher as most stocks fell in Asian trade, offering a lift to the standby anti-risk currency. The MSCI Asia Pacific regional equities benchmark slid 0.7 percent, led by the technology shares. The move echoed performance on Wall Street, a deep slide in IT-related names saw the S&P 500 spike down to a six-day low.

Need help turning market news into a strategy? See our trading guide !

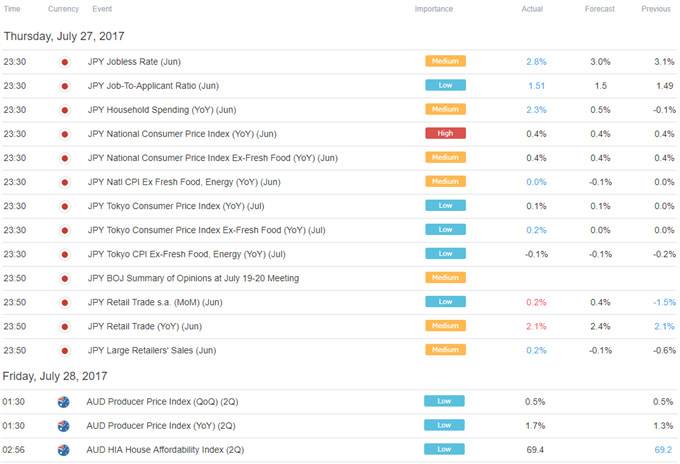

Asia Session

European Session

** All times listed in GMT. See the full DailyFX economic calendar here.

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To receive Ilya's analysis directly via email, please SIGN UP HERE

Contact and follow Ilya on Twitter: @IlyaSpivak