Talking Points:

- Yen outperformed amid risk aversion in Asian trade

- S&P 500 futures hint more of the same is due ahead

- Euro unmoved after as-expected German GDP data

The Japanese Yen outperformed in otherwise quiet Asian trade as stocks declined, boosting demand for the perennially anti-risk currency. The New Zealand Dollar proved weakest on the session. Prices fell with local bond yields, hinting the move was continuation of RBNZ-inspired momentum.

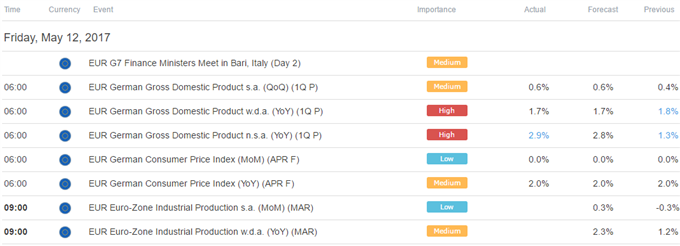

The Euro was understandably unmoved after first-quarter German GDP figures crossed the wires. Not only did the numbers register squarely in line with expectations, but their limited implications for near-term ECB monetary policy trends probably meant that they were always going to fall on deaf ears.

From here, a seemingly potent offering of US economic data seems unlikely to inspire much activity. CPI, retail sales and consumer confidence numbers are all due to cross the wires but with the probability of a June Fed rate hike already priced in at 100 percent, their impact may be minimal.

This creates an opening for sentiment trends to remain at the forefront. S&P 500 futures are looking increasingly negative in early European hours, hinting at a risk-off bias once Wall Street comes online. That suggests the Yen is likely to remain on the offensive into the week-end.

Rhetoric emerging from the on-going meeting of G7 finance ministers in Bari, Italy may erode confidence further. While the thorny issue of international trade is off the agenda, sideline commentary underscoring lingering deadlock between US officials and their counterparts may sour investors’ mood.

Retail traders are betting on a stronger Yen. Find out here what that hints about the price trend!

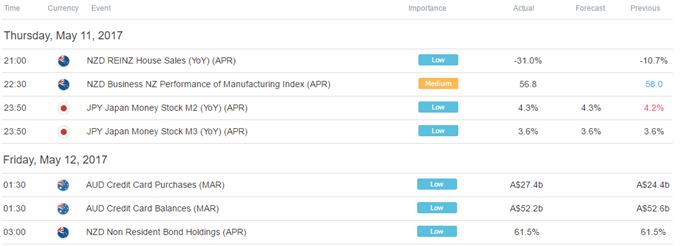

Asia Session

European Session

** All times listed in GMT. See the full DailyFX economic calendar here.

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To receive Ilya's analysis directly via email, please SIGN UP HERE

Contact and follow Ilya on Twitter: @IlyaSpivak