Canadian Dollar, USD/CAD Talking Points:

- USD/CAD set a fresh September high on Monday and yesterday prices snapped back to a key support zone more than 200 pips away.

- Prices in USD/CAD are now sitting on the same 1.2631 level that held the lows last Friday.

- The analysis contained in article relies on price action and chart formations. To learn more about price action or chart patterns, check out our DailyFX Education section.

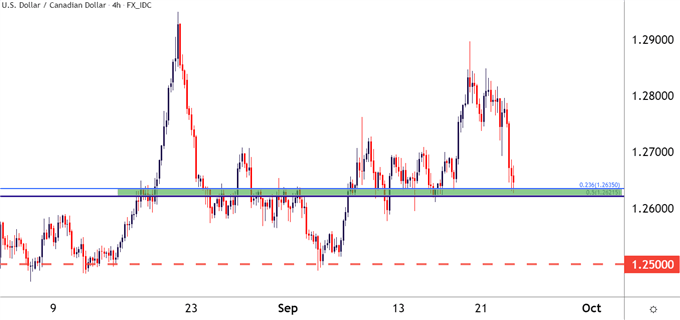

Earlier in the week USD/CAD brought the excitement when the pair ran up to a fresh September high, threatening a test of the prior 2021 high at 1.2950 and potentially even a re-test of the 1.3000 psychological level. That breakout had already begun to pullback by mid-day on Monday, and prices have driven through both of the higher-low supports that I had looked at previously. Now, we’re at the last stop of support that I had looked at and it’s a big one as this is the same price that’s been in-play since January.

The prices in question are at 1.2621 and 1.2631; the latter of which is the 23.6% Fibonacci retracement of the 2020-2021 sell-off while the former is the 50% marker of the longer-term 2002-2007 major move. Together, these prices create a confluent zone that’s been very active over the past month as both support and resistance.

To learn more about Fibonacci, check out DailyFX Education

USD/CAD Four-Hour Price Chart

Chart prepared by James Stanley; USDCAD on Tradingview

USD/CAD Bigger Picture

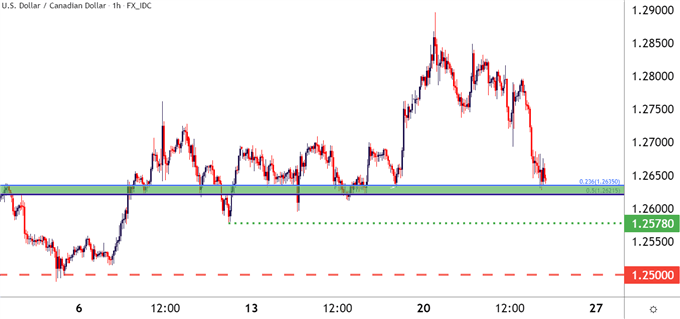

This recent move in USD/CAD mirrors that of the US Dollar fairly well, where an early-week spike dissipated with a hastening in the move around FOMC. But, price action is price action and at this point there are but a couple of options for traders looking to build strategy around USD/CAD.

Given the push down to support combined with a show from buyers, range scenarios remain possible, looking for a push back towards 1.2700 or perhaps even 1.2750.

On the bearish side of the pair, there is breakdown potential given the re-test of this well-trafficked support zone. The 1.2500 psychological level remains of interest underneath price action and that price helps to mark the current monthly and September low in the pair. There’s also a price action swing around 1.2578 that could be used as a more nearby area of support before that 1.2500 level might come back into play.

To learn more about psychological levels, check out DailyFX Education

USD/CAD Hourly Price Chart

Chart prepared by James Stanley; USDCAD on Tradingview

--- Written by James Stanley, SeniorStrategist for DailyFX.com

Contact and follow James on Twitter: @JStanleyFX