Bitcoin, BTC/USD Talking Points:

- Bitcoin had a bad day yesterday as BTC/USD slid from above 57k to below 51.

- After finding support on Tuesday, BTC pushed up to find resistance in a prior support zone, at which point bears pounced to drive another fresh lower-low.

- Assisting the slide was a warning from Billionare Hedge Fund magnate, Ray Dalio, who warned that the government could move to ban Bitcoin similar to how it had previously done on Gold.

- The analysis contained in article relies on price action and chart formations. To learn more about price action or chart patterns, check out our DailyFX Education section.

Well, at least it was a really strong first 2.5 months of Q1.

For the past 12 days crypto-currencies have been on their back foot after Bitcoin set yet another fresh all-time-high on March 13th. This time, BTC pushed above 60k, albeit temporarily, but the retreat from those highs has so far been brought upon by a consistent print of lower-lows and lower-highs. At this point, the pullback has run by as much as -18.5%, but this isn’t even the largest pullback in BTC/USD during Q1. That took place in the last week of February when Bitcoin was off by 25% in a one-week-period.

Perhaps thickening the drama currently is the broader question around risk assets. As quarter-end nears and as the US economy appears to be on firmer footing, expectations have begun to arise that the Fed may not be able to sit on this super-dovish policy stance for as long as they’d hoped. With price pressures showing in key commodity markets like Lumber, Tin or Copper, the expectation is that this will eventually filter into the CPI and PCE data that the Fed looks at when making policy decisions. This explains why rates markets have run so hard in Q1, with yields on the 10-year Treasury note jumping by as much as 90% during the period.

And more recently, even as the Fed has continued to transmit in multiple ways both their expectation and desire to keep policy super dovish until absolutely necessary, markets have continued to coagulate, with tech stocks showing pressure to go along with that rise in yields. And, more recently, that’s begun to hit cryptocurrencies as indicated by this -18% slide in Bitcoin in less than 2 weeks.

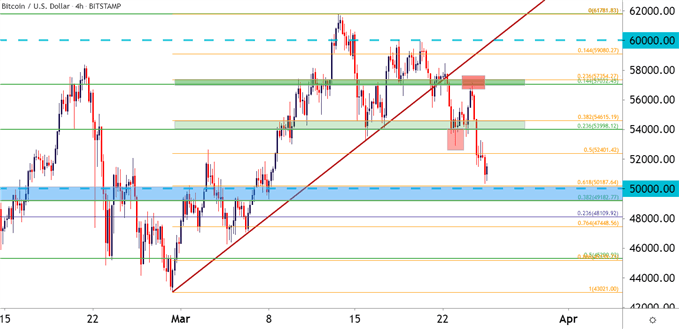

As looked at on Tuesday, Bitcoin started the week with a test of trend support. But, that support couldn’t hold the pressure of sellers and prices slinked down to the ‘s2’ level looked at in that same article. A bounce from ‘s2’ found resistance at ‘s1,’ at which point another driver came into the fray in the form of some comments from famed Hedge Fund Manager, Ray Dalio.

That helped to elicit a really clean push down towards the 50k level, which hasn’t yet come into play. But, if/when it does, that’ll be an important test as BTC/USD tests a very key psychological level.

To learn more about Fibonacci or Trendlines, check out DailyFX Education

BTC/USD Four-Hour Price Chart

Chart prepared by James Stanley; Bitcoin on Tradingview

Bitcoin Moving Forward – Bulls Face a Big Test at Confluent Support

The elephant in the room is what and how the US government may look to regulate cryptocurrencies in the future. Recently Treasury Secretary Janet Yellen offered some non-supportive comments on the matter, alluding to the potential for illicit use or the inability to control the cryptocurrency market.

And in pertinence to current matters – it was a set of comments from Ray Dalio that appeared to get the market’s attention when he said that he thought the government would move to ban crypto currencies, similar to how they’d done with Gold in the past.

And given the incredibly unique context of the situation, it’s really impossible to say that Mr. Dalio is wrong or incorrect; it may well be on the horizon as global governments that have become dependent on printing capital look to protect their position in the market while tamping down on a possible competitor.

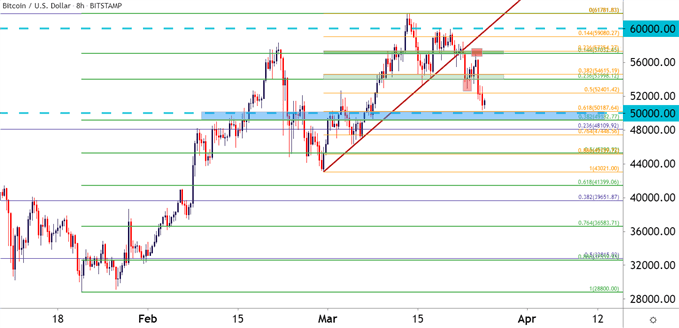

But to mesh this with the technical perspective – there’s a big zone of confluent support sitting just underneath current price action that may offer a ‘tell.’ There are Fibonacci levels at 49,182 and 50,187. In between those two prices is the 50k psychological level, and in a market like Bitcoin, psychological levels may take on even more importance as there are a plethora of retail traders that may act around them.

Frankly, Bitcoin at 49,999.99 seems significantly cheaper than just 2 cents below 50,000.01; and this is why psychological levels can often carry impact in markets, particularly those with heavy retail interest.

Psychological levels can play a big role in technical analysis – check out DailyFX Education to learn more

BTC/USD Eight Hour Price Chart

Chart prepared by James Stanley; Bitcoin on Tradingview

--- Written by James Stanley, Senior Strategist for DailyFX.com

Contact and follow James on Twitter: @JStanleyFX