Canadian Dollar Price Forecast:

- The week began with a quick shot of risk aversion on the back of Covid fears.

- After a rush of USD-strength to start the week, sellers have returned. Is this week’s start with USD strength but a blip? Or a sign of trends to come?

- The analysis contained in article relies on price action and chart formations. To learn more about price action or chart patterns, check out our DailyFX Education section.

It’s been a fast start to the week as yet another twist has appeared in the continued Covid saga. A more contagious mutation in the virus has created a swell of worry across-the-world; potentially upsetting the positive shifts that have taken place since early-November when vaccine news began to populate the headlines.

At this point, most science-based sources seem to indicate that there’s no reason to think that this mutation does anything to make vaccines less effective. And, as such, the general gist behind this morning’s movement appears to be a ‘buy the dip’ type of mantra as stocks have so far started to recover from that overnight sell-off.

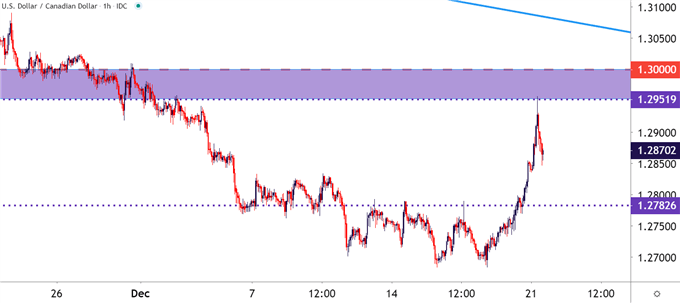

The US Dollar put in a quick flicker of strength, filling the gap from last week’s open. But, sellers have quickly returned to push prices back down. In USD/CAD, this is pertinent as the major pair mirrors the USD move fairly well. In USD/CAD, that rush of risk aversion helped USD/CAD to push up to a very key zone on the chart – the same area that helped to set support into the 2020 open, around the 1.2952-1.3000 area on the chart.

USD/CAD Hourly Price Chart

Chart prepared by James Stanley; USDCAD on Tradingview

On a near-term basis, the big question is whether buyers step-in to offer some higher-low support, and there are two key price zones to follow for such an observation. The first comes from a group of short-term swing-highs that showed-up in early-December around the 1.2833 area. The second is about 50 pips lower around 1.2783, which is the September 2018 low that happened to also come into play a couple of times last week as swing-high resistance.

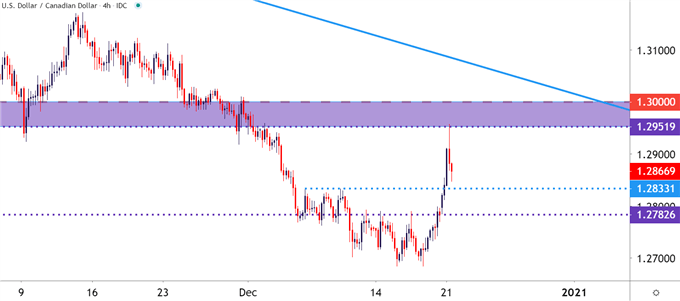

USD/CAD Four-Hour Price Chart

Chart prepared by James Stanley; USDCAD on Tradingview

USD/CAD Longer-Term: Door Remains Open for Bears Sub-1.3000

Going back to the longer-term Daily chart, and that door for bearish continuation remains open. This morning’s flicker of risk-aversion helped USD/CAD to perch above that 1.2952 level, albeit temporarily.

For those looking at longer-term USD weakness, this could be an attractive setup to follow in the near-term.

USD/CAD Daily Price Chart

Chart prepared by James Stanley; USDCAD on Tradingview

--- Written by James Stanley, Strategist for DailyFX.com

Contact and follow James on Twitter: @JStanleyFX