US Dollar, EUR/USD Talking Points:

- While US consumers were online shopping in droves, the US Dollar put in a downside break to fresh two-year-lows.

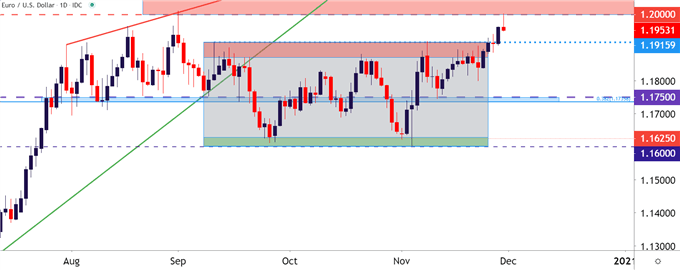

- Correspondingly, EUR/USD has pushed up for a re-test of key resistance at the 1.2000 psychological level.

- Will USD-sellers be able to continue driving through December trade, with the ECB expected to make their own stimulus announcement in a week-and-a-half?

- The analysis contained in article relies on price action and chart formations. To learn more about price action or chart patterns, check out our DailyFX Education section.

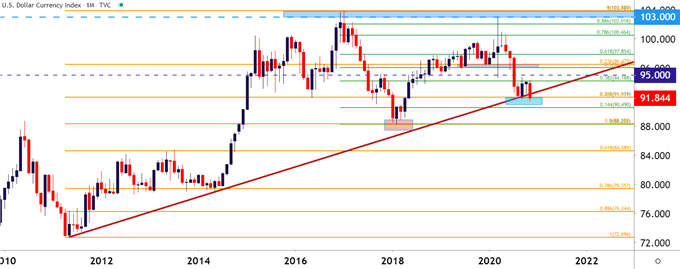

US Dollar Fresh Two-Year Lows

It’s the final day before the final month of 2020, and on theme for this year’s FX price action the US Dollar is testing a fresh two-year-low ahead of the December open. This morning brought announcement from the Treasury department of an extension of the FOMC’s emergency lending programs: This reverses last week’s announcement that was going to allow those programs to expire at the end of the year due to a lack of use. But, one of the reasons for carrying a big bazooka is for the precise reason that you don’t want to use it, with the simple threat of its use creating the behaviors that’re wanted: And with these programs now extended to March 31 of next year, market participants could have more confidence in taking on more risk knowing that there is a bigger backstop behind markets, if need be.

With those programs now extended through March 31st, which will allow time for incoming Treasury Secretary Janet Yellen to get a handle on the situation, there could be scope for even further USD losses. Adding to that bearish potential is the fact that the monthly US Dollar chart is showing a not-yet-completed evening star formation, combined with a test through a very major support zone, which could keep the door open for continued USD-weakness into the end of the year and perhaps even through the 2021 open.

To learn more about evening star formations, join us in DailyFX Education

US Dollar Monthly Price Chart

Chart prepared by James Stanley; USD, DXY on Tradingview

US Dollar Bearish Thesis: What Will the ECB Do?

One of the more interesting aspects of the FX market is one of valuations. Because currencies are the base of the financial system, there’s no other way to value a currency other than other currencies. This is why FX is traded in pairs, and its creates a relative valuation scenario. If a currency as large and widespread as the US Dollar is going to drop in value, then, relatively speaking, other currencies would have to rise in value. The big question is which currencies are primed for strength as pretty much every large Central Bank the world-around is already deep into monetary accommodation.

And pertinent to EUR/USD: With the Euro being such a large allocation of the DXY split, with more than 57% of the US Dollar dedicated to the single currency, there’s an item of interest pertaining to US Dollar bearish scenarios; and that’s whether the EUR/USD spot is going to find fertile ground above the 1.2000 psychological level.

The ECB is widely-expected to increase their own stimulus allotment at their December rate decision, set for next Thursday (Dec 10th). Normally, an increase in stimulus is the type of thing that can weaken a currency, and the question now is whether EUR/USD will continue to gain ground north of 1.2000 even as the ECB announces an increase in stimulus.

EUR/USD attempted to incline above 1.2000 back in September; but that failed in a very noticeable way. A few weeks later, EUR/USD had worked into a range and that lasted into last week’s trade, with EUR/USD finally putting in a range breakout on Black Friday.

But, now that US markets are open and with the Central Bank focus beginning to move across the Atlantic, the big question is one of continuation potential.

To learn more about psychological levels, please join us in DailyFX Education

EUR/USD Re-Tests 1.2000 Psychological Level

Chart prepared by James Stanley; EUR/USD on Tradingview

--- Written by James Stanley, Strategist for DailyFX.com

Contact and follow James on Twitter: @JStanleyFX