US Dollar, EUR/USD, GBP/USD, AUD/USD Talking Points:

- The US Dollar continues to hang around longer-term support.

- EUR/USD remains in a range, and range continuation in EUR/USD could be attractive for those looking at long-USD scenarios.

- GBP/USD has a bullish backdrop as a series of higher-lows goes along with a re-test of a key spot of resistance. Can bulls break through this time?

- The analysis contained in article relies on price action and chart formations. To learn more about price action or chart patterns, check out our DailyFX Education section.

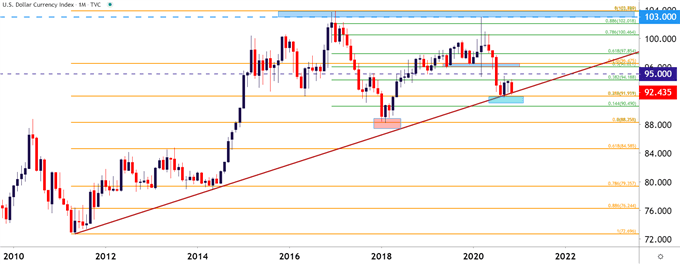

The US Dollar is continuing to dig into longer-term support; and at this point, prices in USD are riding along a trendline projection with a batch of confluent Fibonacci levels sitting just below.

This is the same trendline projection that had come into play around the September open, helping to arrest a six-month-sell-off in USD before a bounce showed up in October. That bounce was short-lived, however, and as election results got priced into FX markets, the US Dollar went right back into drop mode and has re-engaged with this bearish trendline.

Accordingly – a number of major pairs are at resistance to go along with this USD support test, including EUR/USD, GBP/USD and AUD/USD, all testing big levels on their respective charts.

US Dollar Monthly Price Chart: Digging into Support

Chart prepared by James Stanley; USD, DXY on Tradingview

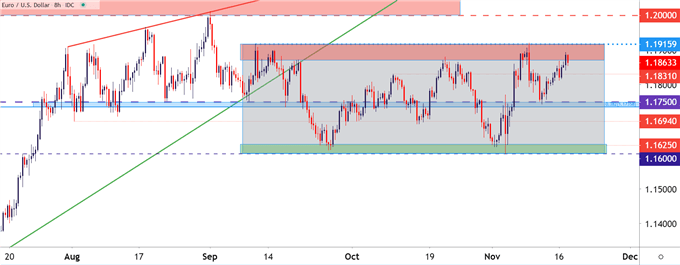

EUR/USD Remains in Range – Can Buyers Push Through

Of USD major pairs that may be attractive for USD-strength, whether that’s a mild bounce or the start of a reversal – EUR/USD may fit the bill. The ECB is expected to amp-up stimulus at the December meeting and logically speaking, they need to do something as the continent’s economies are beset by the second wave of covid. Generally speaking, ECB stimulus has spelled for a weaker Euro and with the EUR/USD spot inching closer to that 1.2000 level, there may be even more motivation for the ECB to actually do something this time.

In EUR/USD, the pair has been in a range for a couple of months now, with support showing around the 1.1600 area and resistance around the 1.1900 area, which the pair is trading above, as of this writing. This can keep the door open for short-side scenarios, looking for the mean-reversion theme to continue as we move closer to that December ECB rate decision.

EUR/USD Eight-Hour Price Chart

Chart prepared by James Stanley; EUR/USD on Tradingview

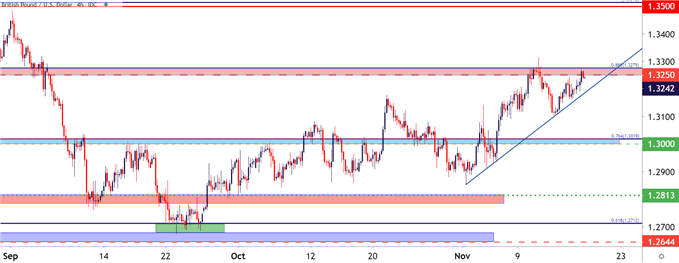

GBP/USD Re-Engages Resistance, Bulls Back Higher-Lows

GBP/USD is testing a key zone of resistance at the moment, running from 1.3250-1.3275. This is the same area that helped to catch the highs last week; but when prices pulled back, bulls showed up to build another higher-low. This has allowed for the build of a bullish trendline to go along with that batch of resistance, and as looked at yesterday, this could keep the door open for bullish breakout potential. This wouldn’t quite be a picture-perfect ascending triangle, but there’s similar drives behind the current GBP/USD backdrop; and a topside break above this resistance opens the door for a run at the 1.3400 area on the chart.

This scenario could be attractive for themes of USD-weakness; and for those looking to offset long-USD exposure from a short EUR/USD setup, the long side of GBP/USD may present an attractive hedge in the USD.

GBP/USD Four-Hour Price Chart

Chart prepared by James Stanley; GBP/USD on Tradingview

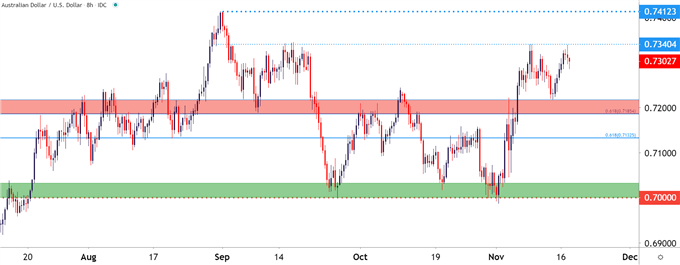

AUD/USD Bulls Continue to Push

Commodity currencies have been quite strong of recent, and this includes all of NZD, CAD and AUD. The latter, in particular, has been visibly strong since refusing to break-down below the .7000 handle earlier in November. But, as USD-weakness drove back into FX markets, AUD/USD flew up to a familiar area before finding some resistance, taken around the .7340 level on the chart.

| Change in | Longs | Shorts | OI |

| Daily | -4% | -10% | -6% |

| Weekly | -1% | 25% | 3% |

Last week’s resistance inflection in AUD/USD led to a pullback to support around prior resistance, taken from the .7185-.7205 zone. But, that support inflection merely allowed for prices to push back up to resistance, where AUD/USD price action is holding near.

This keeps the door open for topside breakout potential, and this can become an attractive scenario in the event of a USD test below that big spot of support looked at above. The big resistance level ahead on AUD/USD is the .7412 level that currently functions as the two-year-high in the pair; and this is the level that capped the advance in September of this year, going along with that USD reversal discussed earlier.

AUD/USD Four-Hour Price Chart

Chart prepared by James Stanley; AUD/USD on Tradingview

--- Written by James Stanley, Strategist for DailyFX.com

Contact and follow James on Twitter: @JStanleyFX