Bitcoin, BTC, BTCUSD Price Analysis:

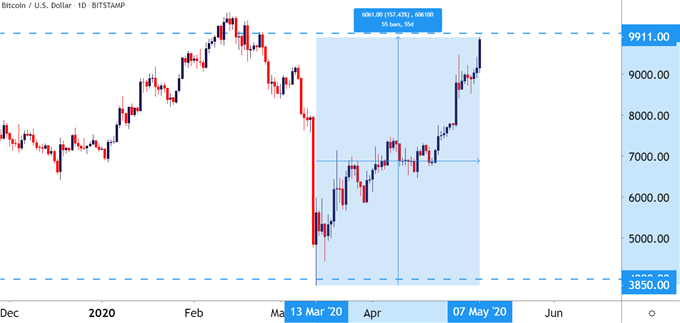

- The Bitcoin ramp has continued and BTC is now up by more than 150% from the March lows.

- Bitcoin mania in 2017 led to heartbreak for Bitcoin bulls in 2018, as the cryptocurrency gave back 84% of its value following the astronomical gains from the year before.

- The big question now whether this recent round of monetary stimulus, combined with what additional stimulus might be on the horizon – are the game-changing drivers that Bitcoin bulls have been waiting for. Famed investor and Hedge Fund owner/manager/trader Paul Tudor Jones has come out in support of Bitcoin in a note earlier today.

- The Bitcoin halving is expected to take place next Wednesday, and that was discussed in more depth by my colleague Nick Cawley earlier this morning.

Bitcoin Breaks Out

One of the reports making the rounds through markets today is news that famed Hedge Fund Manager and Trader Paul Tudor Jones has openly embraced cryptocurrencies in a note titled ‘The Great Monetary Inflation.’ As mentioned in the linked Bloomberg article, this would mark one of the biggest and most well-known investors to publicly support Bitcoin, as he drew parallels to Gold in the 1970’s.

Paul Tudor Jones has become a market icon, particularly on macro matters, after being credited with forecasting the 1987 S&L crash; and since then he’s been widely followed for his market commentary, often looking at or into cross-market relationships and how he and his fund and investors might benefit from them.

Regarding Bitcoin – there’s somewhat of a burgeoning theme in the backdrop at the moment as the cryptocurrency is up more than 150% from the March lows. After touching below the $4k level temporarily in March, Bitcoin is making a fast run at the $10k marker this morning, apparently helped along by that very public admission of support from Paul Tudor Jones.

Bitcoin Daily Price Chart

Chart prepared by James Stanley; Bitcoin on Tradingview

Central Bank Stimulus as a Bitcoin Driver?

Probably the most interesting aspect of this morning’s news around Paul Tudor Jones was the fact that he said something that many have been thinking, or fearing for some time now. The fact that this came from such an esteemed market voice on what has been such a contentious topic is likely what’s made it so widely-circulated and, going by the chart today, potentially impactful. There was a similar drive in Gold prices after the Financial Collapse as global Treasury departments and Central Banks turned the printing presses into high gear.

Logically, such monetary dilution should, long-term, lead to some element of inflation. Money printing isn’t necessarily value creation, after all. But that didn’t really happen in the wake of the Financial Collapse as inflation was tame and many Central Banks remained ‘pedal-to-the-floor’ on monetary stimulus. So when risk factors flared as the coronavirus took the globe by storm, monetary stimulus quickly ramped up again as global governments attempted to offset the pressure that was sure to show in the economic data in the weeks and months to come. The fears of moral hazard that were so commonplace around the response to bailouts and QE during the 2008 Financial Collapse were somewhat buffered by the fact that governments have been actively engaged in QE in the decade since without seeing significant inflation; at least as of yet.

Tomorrow brings an NFP report that may have a US unemployment rate in the double digits; a far cry from the 50-year-lows that were showing in that indicator just a few months ago. But, so far, equity markets in the US remain very near highs that were set in February as the initial sell-off in stocks has been largely wiped away by stimulus-driven enthusiasm.

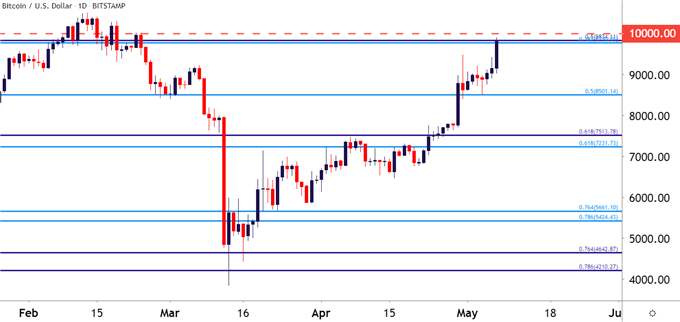

Bitcoin at Big Resistance: Can Bulls Break Through?

At this point there are a few different mechanisms of resistance in a relatively tight area, showing around the $10k psychological level that’s helped to bring sellers into play a couple of different times going back to October of last year. Very near that $10k marker is the 50% level of the 2012-2017 major move in Bitcoin, as well as the 38.2% retracement of the 2018-2019 major move.

What does all of this confluence mean? There may be even more motive for sellers to enter the equation as prices are testing an area with multiple resistance levels at the same time.

Bitcoin Daily Price Chart

Chart prepared by James Stanley; Bitcoin on Tradingview

Bitcoin Continuation Potential with Big Resistance Ahead

The trend in Bitcoin since those March lows were put in place is undeniable; it’s been strong and largely one sided as the market has moved up by more than 150%. So, there are some very real fears of this move already being overbought as prices near a confluent zone containing multiple resistance levels.

But, at this stage, there’s little to suggest that this theme is yet over and, given the very same drive that was shared in the note from Mr. Paul Tudor Jones, there could be continued motive for further topside in Bitcoin as global governments, especially the US, look at a wide array of stimulus options to help the American economy through the coronavirus scenario.

Regarding timing, however, and an important item of note: Retail traders observed in the IGCS data are overwhelmingly bullish, with approximately 85% of traders long, as of this writing. Given that retail sentiment is often looked at with a contrarian aim, this could urge further caution towards chasing the trend, at least for now, as Bitcoin price action tangles with a series of resistance levels after a really strong topside push from the March lows.

To learn more about market sentiment, there’s an entire sub-module of content on the topic in the recently revamped DailyFX Education section.

--- Written by James Stanley, Strategist for DailyFX.com

Contact and follow James on Twitter: @JStanleyFX