Canadian Dollar, USD/CAD, Loonie Talking Points

- USD/CAD gapped-up to fresh two-year-highs this morning.

- The brutal sell-off in Oil is further contributing to CAD-weakness.

- While the US Dollar has been extremely weak, the Canadian Dollar has remained even weaker, keeping the door open to bullish strategies there.

Canadian Dollar Slammed on the Open, USD/CAD to Fresh Highs

This is the type of morning when there’s so much to write about or analyze for trading setups that it can be difficult to pick out just one or two markets to work with. But, in the FX space, few pairs are as interesting as USD/CAD and there are a number of reasons for this. Perhaps first and foremost, this is one of the few major currency pairs that’s actually showing USD-strength. Secondly, given that profound weakness in the Canadian Dollar, there may be room for more, especially with the hit that’s being seen in Oil markets around-the-world. And, perhaps most importantly, The pair continues with a trend that’s remained fairly consistent so far in 2020 trade, which is a trend of strength; as most other markets have already exhibited some form or reversal or snap back, USD/CAD has been fairly consistent, by and large.

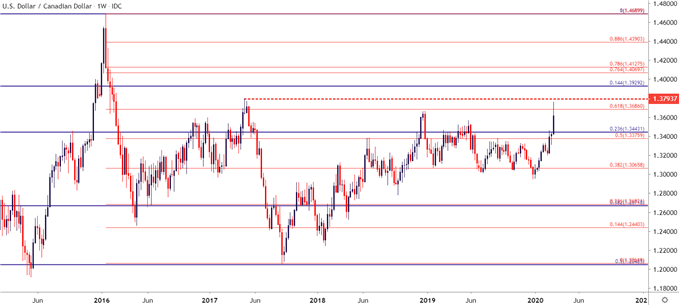

After coming into 2020 trading below the 1.3000-handle, buyers have come back, in droves, to push prices up to a fresh two-year-high, intersecting with the resistance zone that capped the top in May of 2017 around the 1.3750-1.3800 area on the chart.

USD/CAD Weekly Price Chart

Chart prepared by James Stanley; USDCAD on Tradingview

USD/CAD Gap-and-Go

As looked at over the past few weeks, perhaps the most interesting aspect of USD/CAD is the fact that this is one of the very few pairs that’s showing some element of USD-strength. This stands in stark contrast to pretty much every other major currency pair such as EUR/USD, GBP/USD, USD/JPY, etc. This denotes how the Canadian Dollar has been even weaker than its US cousin and, by and large keeps the door open for themes of continuation.

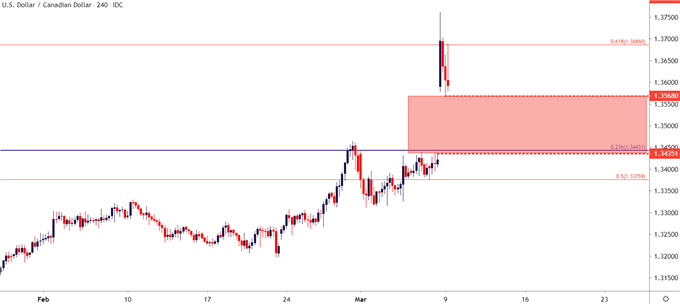

I had looked into breakout potential in USD/CAD just a couple of weeks ago and that breakout has continued to fill-in. At this point, price action is not only overbought but there’s a large gap remaining on the chart: Setting up a daunting backdrop for continuation at the moment.

For those looking to add long exposure in the pair, waiting for this gap to get filled and, perhaps even looking for some support around prior resistance may be an attractive manner of address. As of this writing, there’s approximately 133 pips of unfilled gap on the USD/CAD price chart.

USD/CAD Four-Hour Price Chart

Chart prepared by James Stanley; USDCAD on Tradingview

--- Written by James Stanley, Strategist for DailyFX.com

Contact and follow James on Twitter: @JStanleyFX