Talking Points:

- Next week’s economic data is rather light, but the latter portion of the week brings the Jackson Hole Economic Symposium, and this will likely steal a majority of market participants’ attention.

- The big question is whether we can see fresh trends develop in major currencies as the Fed and ECB each look at the prospect of tighter policy options. At the Fed, the big question is around the Balance Sheet, and at the ECB, the big question is when they might start to taper stimulus.

- If you’re looking for trade ideas, check out our Trading Guides. And if you’re looking for shorter-term ideas, please check out our IG Client Sentiment.

To receive James Stanley’s Analysis directly via email, please sign up here.

Next week’s economic data is rather slow, but this is likely a blessing as much of the attention from global markets will be cast towards Wyoming. This is where the who’s who of global Central Banks will meet at Jackson Hole for the annual policy conference, and Fed Chair Janet Yellen will be the headline of the event with a speech to be delivered at 10 AM Eastern Time on Friday Morning (August 25th). We’ll also get a special appearance from ECB President Mario Draghi; but traders should avoid getting their hopes up for any announcements around what the European Central Bank plans to do around stimulus, as reports have already indicated that this is not in the plans as the ECB hosts a pivotal rate decision just two weeks later. Mr. Draghi had previously made a splash at Jackson Hole at the 2014 Symposium, when he presented his case against austerity just before the ECB launched their QE program in March of 2015.

This will be the first symposium since the Global Financial Collapse where the predominant focus for many central banks has shifted towards tightening. While the Fed had already started to lift rates ahead of last year’s event, the Dollar had spent most of 2016 moving-lower. At Jackson Hole , the one-two punch of Janet Yellen and Fed Vice Chair Stanley Fischer elicited a move of strength in the Dollar, and this kept the Greenback rather strong as we walked into the Presidential Election a couple months later.

On the chart below, we’re looking at how this shift worked out in ‘DXY’ as a representation of the U.S. Dollar. In the red box on the left portion of the chart, we’re looking at pre-Jackson Hole price action in the Dollar in 2016. The green box indicates the quick spike of strength that came into the Greenback around Yellen and Fischer’s comments, and in blue, we’re looking at the follow-thru of the move as we approached the Presidential Election (post-Election price action represented in grey).

U.S. Dollar Daily via ‘DXY’: Last Year’s Jackson Hole (in Green) Provided a Boost to the Dollar

Chart prepared by James Stanley

2017 has been brutal for the U.S. Dollar (shown in orange above), and this is likely due to a number of factors. After the post-Election boost (in grey in the above chart), expectations for U.S. data had become rather elevated. As actual data prints in the early portion of the year were unable to keep pace, this led to an initial move of weakness throughout January. The Dollar spent most of February moving-higher, but as we got the next rate hike out of the Fed in March, the Dollar crumbled and continued to run-lower, continuing to post lower-lows and lower-highs.

The question would then be: What happened in March of this year that might have changed matters?

Perhaps not coincidentally, this is when the Fed initially started talking about the prospect of balance sheet reduction. The meeting minutes from the March rate decision showed that this is when the Fed first said that they anticipated being able to gradually start reducing the balance sheet later in the year. After that rate decision in the middle of March, numerous Fed officials mentioned this in interviews, and at subsequent rate decisions in June and July, this was very much the elephant in the room. This would then raise another very relevant question:

Why Would the Dollar Fall When the Fed Signals Plans to Tighten Via the Balance Sheet?

After all, if tightening is indication of strength, shouldn’t this be a ‘good’ thing for the U.S. economy, given that the backdrop is so solid that the bank can look to both tighten rates and sell bonds to implement what would, in essence be a ‘dual-tightening mandate’?

That’s where the rubber meets the road: Not only has U.S. data been soft, to the point where many question the Fed’s persistence towards continually hiking rates while inflation remains relatively subdued, but markets appear to be fading the prospect of the Fed hiking rates while also reducing the balance sheet. Given that rates are that ‘big’ driver for currency prices (higher rates = greater demand to capture the new, higher rates), this could produce a softer backdrop for higher rates out of the U.S., thereby leading to even fewer reasons to be long the Dollar as the Fed is now going to look to tighten the money supply by selling bonds rather than raising rates.

Mechanically – this should have a similar impact, and this is likely what the Fed is looking at/hoping for. Selling bonds means prices drop and yields rise. But there are other factors to consider: As in, what is the rest of the bond market going to do when one of the biggest buyers of debt recedes into the background? One of the reasons that rates have stayed so low in the post-Financial Collapse backdrop is because of continued reinvestment from the Fed. This has kept the Federal Reserve as active buyers in many key debt markets, and this artificially elevates price from exogenous demand (while also crimping yields). But when the biggest force in that market signals that they’re going to gradually be taking a back seat, are there as many reasons to continue buying in that market, expecting demand to stay constant even with the diminished activity from the gorilla in the bond market?

These are all questions that could receive some clues next week. Below, we’re looking at three of the more popular FX markets from a longer-term basis in order to see what traders might be able to watch for as we approach the 2017 Jackson Hole Economic Symposium.

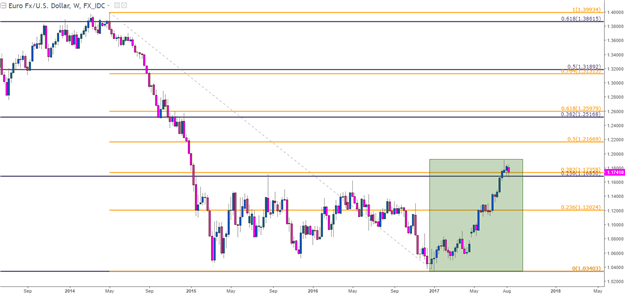

EUR/USD: Will the trend bend, or get another shot-in-the-arm?

This is probably one of the more interesting areas for Forex traders, as we’ve seen a fairly significant shift in expectations around the Euro-zone so far this year. EUR/USD has spent most of 2017 moving-higher, and just two weeks ago we broke above a key area of resistance at 1.1685-1.1736. But since that top-side break, prices haven’t been able to move much-higher, as support continues to show around this prior area of resistance.

EUR/USD Weekly: A Strong 2017 Drives Prices Above Confluent Resistance Zone

Chart prepared by James Stanley

Since breaking above that zone, bullish momentum has begun to wane, and we’ve seen a series of re-tests of support around 1.1685. This has created a bull flag formation, as this down-ward sloping, counter-trend channel populates around the retracement.

EUR/USD Daily: Bull Flag Developing After Break Above Confluent Resistance/Support

Chart prepared by James Stanley

USD/JPY: Is the Range Ready to Finally Give?

USD/JPY has been caught in a range now for the past four months. And this has been a rather vicious range, as there’s approximately 500 pips between support and resistance. Making matters more confounding: The post-Election bullish move spent the first few months of the year retracing, and now with four months of range, there is a lack of discernible long-term direction on USD/JPY.

USD/JPY Weekly: Range-Bound (in purple) After a Prior Proclivity to Trend

Chart prepared by James Stanley

On the Daily chart below, we’re focusing-in on this recent range in USD/JPY. We’re currently sitting in support as prices are testing the August/June lows around 109.00. Resistance has been rather clean after two tests of 114.55, which is the 23.6% retracement of the ‘post-Election’ move in USD/JPY.

Chart prepared by James Stanley

GBP/USD: Confluent Support Remains

The British Pound has had its own issues throughout 2017, as the country wades through an uncertain future as Brexit negotiations continue. One of the few certainties that we do have is that the BoE is likely going to remain as dovish as they can, for as long as they can – and we just got another reiteration of that earlier in August when the BoE discussed the prospect of rising inflation.

So, while Cable was strong coming into August, a large portion of that move can be attributed to USD-weakness. But since that BoE rate decision, and the NFP report that followed, there’s been a bearish drive in GBP/USD. On the four-hour chart below, we can see GBP/USD stair-stepping lower after that rate decision earlier in the month:

GBP/USD Four-Hour: Bearish Move throughout August After BoE, NFP

Chart prepared by James Stanley

As you can see from the above chart, Cable has spent most of the last week knocking on the door of confluent support. At 1.2848, we have the 61.8% retracement of the most recent bullish move, and this lines up with the bullish trend-line that’s showed up in the pair as support for this year’s move-higher.

GBP/USD Daily: Prices Remain Support at Confluent Zone

Chart prepared by James Stanley

--- Written by James Stanley, Strategist for DailyFX.com

To receive James Stanley’s analysis directly via email, please SIGN UP HERE

Contact and follow James on Twitter: @JStanleyFX