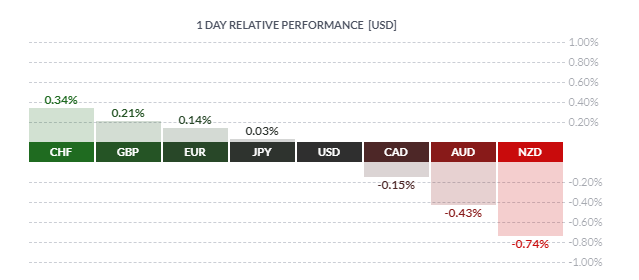

MARKET DEVELOPMENT – AUD & NZD Underperform, Oil Renews Selling as Russia Talks Down Joining OPEC oil cut

AUD / NZD: Trade war tensions between the US and China continuing to take its toll on the high beta antipodean currencies. Both the Aussie and Kiwi are underperforming this morning following amid the fallout of APEC summit in which for the first time its 25yr history failed to yield a joint statement. This consequently raises the risk that President Trump may not meet President Xi at the upcoming G20 summit. On the technical front, resistance at 0.7330 for AUD has continued to hold, while NZD failed to consolidate above 0.6860. Support is situated at 0.73 and 0.68, respectively.

GBP: Another week of volatility is a given for GBP with markets on “confidence vote watch” as MPs continue to send in letters to the 1922 committee. As it stands, GBP has clawed back some of last week’s losses with newsflow relatively quiet thus far.

USD: After the first weekly loss in a month, the US Dollar has begun the week on the backfoot. Cautious Fed commentary has subsequently dampened rate hike expectations with Fed Fund futures pricing in 1 hike by December 2019, relative to the FOMC’s dot plot projection of 3 rate hikes in 2019. Eyes will be on Fed’s Williams later today, however, it is possible that he will follow a similar script as Fed’s Powell and Clarida.

Crude Oil: Fresh selling for Brent and WTI crude futures as Russia stated that they would prefer to take a wait-and-see approach with regard to a potential oil cut. As mentioned previously, an oil output cut would need to have Russia’s involvement in order to increase the influence on lifting oil prices. For the time being Russia remains coy ahead of the December 6th meeting.

Data as of 1420GMT

DailyFX Economic Calendar: Monday, November 19, 2018 – North American Releases

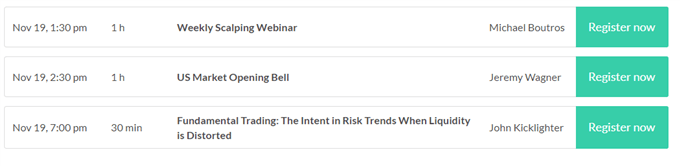

DailyFX Webinar Calendar: Monday, November 19, 2018

Four Things Traders are Reading

- “Weekly CoT Update – Sellers in USD, Crude Oil Speculators Keep Hitting Bids” by Paul Robinson, Market Analyst

- “EURUSD Rise From Dovish Fed Limited by Italian Fears, Eyes on ECB Minutes”by Justin McQueen, Market Analyst

- “UK Week Ahead: Brexit and the Bank of England to Steer Sterling | Webinar” by Nick Cawley, Market Analyst

- “Bitcoin, Ethereum, Ripple Prices Collapse Further - A Sea of Red” by Nick Cawley, Market Analyst

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX