Trading the News: China Consumer Price Index (CPI)

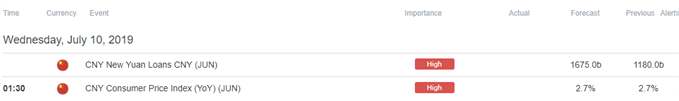

Updates to China’s Consumer Price Index (CPI) may do little to curb the recent decline in AUDUSD as the headline reading for inflation is expected to hold steady at 2.7% in June.

Stagnant price growth in China, Australia’s largest trading partner, may produce headwinds for the Australian Dollar as it puts pressure on the Reserve Bank of Australia (RBA) to further insulate the economy.

In turn, the RBA may continue to endorse a dovish forward guidance at the next meeting on August 6, with the Australian dollar at risk of facing a more bearish fate over the coming months as Governor Philip Lowe and Co. warn that “the risks to the global economy are tilted to the downside.”

However, an unexpected pickup in China’s CPI may curb the recent decline in AUDUSD as it instills an improved outlook for the Asia/Pacific region and undermines speculation for another RBA rate cut.

Impact that China’s CPI had on AUD/USD during the previous release

| Period | Data Released | Estimate | Actual | Pips Change | Pips Change |

|---|---|---|---|---|---|

MAY 2019 | 06/12/2019 01:30:00 GMT | 2.7% | 2.7% | -1 | -26 |

May 2019 China Consumer Price Index (CPI)

AUD/USD 5-Minute Chart

China’s Consumer Price Index (CPI) increased for the third consecutive month in May, with the headline reading climbing to 2.7% from 2.5% per annum in April. In contrast, the Producer Price Index (PPI) narrowed to 0.6% from 0.9% during the same period to mark the first downtick since January.

The batch of mixed data prints spurred a limited reaction in the Australian dollar, with AUDUSD grinding lower throughout the day to close at 0.6928. Learn more with the DailyFX Advanced Guide for Trading the News.

AUD/USD Rate Daily Chart

- Keep in mind, the AUDUSD rebound following the currency market flash-crash has been capped by the 200-Day SMA (0.7093), with the exchange rate marking another failed attempt to break/close above the moving average in April.

- With that said, the broader outlook for AUDUSD remains tilted to the downside, with the exchange rate still at risk of giving back the rebound from the 2019-low (0.6745) as the wedge/triangle formation in both price and the Relative Strength Index (RSI) unravels.

- More recently, the advance from June-low (0.6832) appears to have stalled ahead of the May-high (0.7061), with the break/close below the 0.6950 (61.8% expansion) to 0.6960 (38.2% retracement) region bringing the downside targets back on the radar.

- First area of interest comes in around 0.6850 (78.6% expansion) to 0.6880 (23.6% retracement) followed by the 0.6730 (100% expansion) region.

Sign up and join DailyFX Currency Strategist David Song LIVE for an opportunity to discuss potential trade setups.

Additional Trading Resources

New to the currency market? Want a better understanding of the different approaches for trading? Start by downloading and reviewing the DailyFX Beginners Guide.

Are you looking to improve your trading approach? Review the ‘Traits of a Successful Trader’ series on how to effectively use leverage along with other best practices that any trader can follow.

--- Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong.