Trading the News: U.S. Gross Domestic Product (GDP)

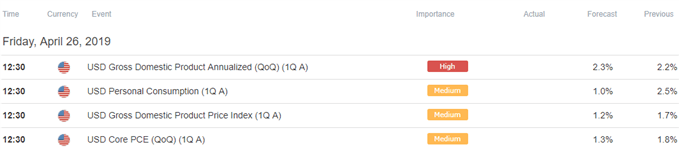

Updates to the U.S. Gross Domestic Product (GDP) report may keep the EUR/USD exchange rate under pressure as the growth rate is expected to increase 2.3% after expanding 2.2% during the last three-months of 2018.

A pickup in economic activity should heighten the appeal of the U.S. dollar as it boosts the outlook for growth and inflation, and little to no signs of a looming recession may encourage the Federal Reserve to further normalize monetary policy in 2019 as ‘some participants indicated that if the economy evolved as they currently expected, with economic growth above its longer-run trend rate, they would likely judge it appropriate to raise the target range for the federal funds rate modestly later this year.’

In turn, a positive development may spark a bullish reaction in the greenback, but a batch of lackluster data prints may generate a mixed reaction especially as the core Personal Consumption Expenditure, the Fed’s preferred gauge for inflation, is expected to narrow to 1.4% from 1.8% during the same period.

Sign up and join DailyFX Currency Analyst David Song LIVE to cover the fresh updates to the U.S. GDP report.

Impact that the U.S. GDP report had on EUR/USD during the previous release

| Period | Data Released | Estimate | Actual | Pips Change | Pips Change |

|---|---|---|---|---|---|

4Q A 2018 | 02/28/2019 13:30:00 GMT | 2.2% | 2.6% | -19 | -35 |

4Q U.S. Gross Domestic Product (GDP)

The advance U.S. Gross Domestic Product (GDP) report showed the economy growing 2.6% during the last three-months of 2018 after expanding 3.4% per annum during the previous period. A deeper look at the report showed the gauge for Personal Consumption increasing 2.8% versus projections for a 3.0% print, while the core Personal Consumption Expenditure (PCE), the Federal Reserve’s preferred gauge for inflation, unexpectedly climbed to 1.7% from 1.6% during the same period.

The U.S. dollar gained ground following the above-forecast GDP print, with EUR/USD slipping below the 1.1400 handle to close the day at 1.1371. Review the DailyFX Advanced Guide for Trading the News to learn our 8 step strategy.

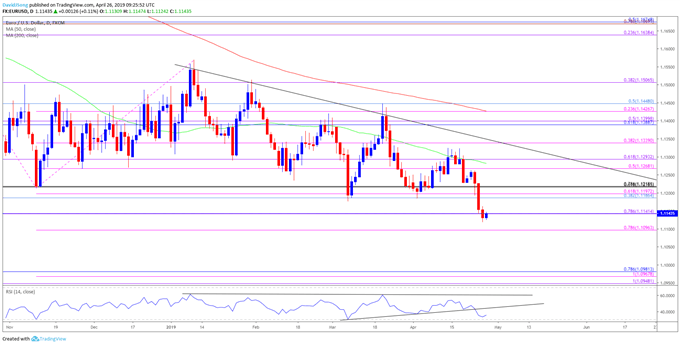

EUR/USD Rate Daily Chart

- There appears to be a broader shift in EUR/USD behavior as the exchange rate threatens the wedge/triangle formation from earlier this year, with the near-term outlook mired by the failed attempt to test the 1.1340 (38.2% expansion) hurdle.

- At the same time, recent developments in the Relative Strength Index (RSI) offer a bearish signal as the oscillator snaps the upward trend from earlier this year.

- In turn, the break/close below the 1.1190 (38.2% retracement) to 1.1220 (78.6% retracement) region brings the 1.1100 (78.6% expansion) to 1.1140 (78.6% expansion) zone on the radar, with the next area of interest coming in around 1.0950 (100% expansion) to 1.0980 (78.6% retracement).

For more in-depth analysis, check out the 2Q 2019 Forecast for EUR/USD

Additional Trading Resources

New to the currency market? Want a better understanding of the different approaches for trading? Start by downloading and reviewing the DailyFX Beginners Guide.

Are you looking to improve your trading approach? Review the ‘Traits of a Successful Trader’ series on how to effectively use leverage along with other best practices that any trader can follow.

--- Written by David Song, Currency Analyst

Follow me on Twitter at @DavidJSong.