Trading the News: New Zealand Gross Domestic Product (GDP)

Updates to New Zealand’s Gross Domestic Product (GDP) report may rattle the NZD/USD rally following the Federal Reserve meeting as the growth rate is expected to narrow to 2.5% from 2.6% per annum in the third-quarter of 2018.

Another downtick in the GDP print may produce headwinds for the New Zealand dollar as it warns of a slowing economy, and a dismal development may push the Reserve Bank of New Zealand (RBNZ) to alter the forward-guidance as the central bank warns ‘trading-partner growth is expected to further moderate in 2019.’

Even though the official cash rate (OCR) sits at the record-low of 1.75%, the weakening outlook for economic activity may encourage the RBNZ to further insulate the economy as the central bank asserts that ‘the direction of our next OCR move could be up or down.’ In turn, a GDP print of 2.5% or lower may spark a bearish reaction in NZD/USD, but a positive development may fuel the advance following the Federal Reserve meeting as it curbs bets for an RBNZ rate-cut. Sign up and join DailyFX Currency Analyst David Song LIVE for an opportunity to discuss potential trade setups.

Impact that the New Zealand GDP report has had on NZD/USD during the previous release

| Period | Data Released | Estimate | Actual | Pips Change | Pips Change |

|---|---|---|---|---|---|

3Q 2018 | 12/19/2018 21:45:00 GMT | 2.8% | 2.6% | -10 | -15 |

3Q 2018New Zealand Gross Domestic Product (GDP)

NZD/USD 15-Minute Chart

New Zealand’s Gross Domestic Product (GDP) report showed the growth rate increasing 2.6% after expanding a revised 3.2% in the second-quarter of 2018. A deeper look at the report showed Mining as the biggest contributor to growth as the sector grew 12.4% in the third-quarter, with Wholesale Trade climbing 1.1.% during the same period, while Utilities suffered a 2.3% decline after rising 4.1% during the three-months through June.

The New Zealand dollar struggled to hold its ground following the below-forecast print, with NZD/USD pulling back from the 0.6800 handle to close the day at 0.6774. Learn more with the DailyFX Advanced Guide for Trading the News.

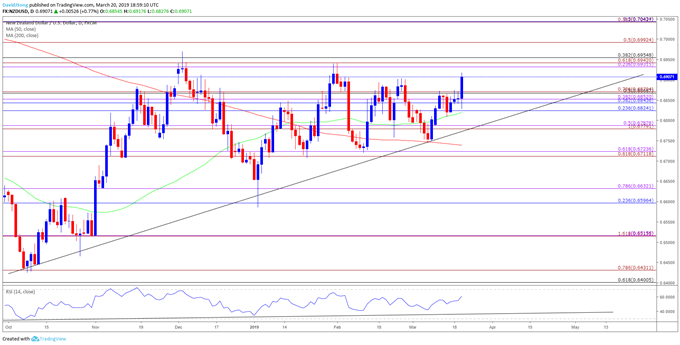

NZD/USD Daily Chart

- Broader outlook for NZD/USD remains fairly constructive as both price and the Relative Strength Index (RSI) continue to track the upward trends from earlier this year, but the exchange rate may face range-bound conditions over the near-term as it appears to be stuck in a long-term wedge/triangle formation.

- With that said, the Fibonacci overlap around 0.6930 (23.6% expansion) to 0.6960 (38.2% retracement) sits on the radar as it lines up with the 2019-high (0.6942), with a break/close above the stated region raising the risk for a run at the December-high (0.6969).

- Next region of interest comes in around 0.6990 (50% expansion) following by the 0.7040 (50% retracement) zone, but failure to hold above the 0.6820 (23.6% retracement) to 0.6870 (78.6% expansion) area may trigger a move back towards 0.6780 (100% expansion) to 0.6790 (50% expansion).

Additional Trading Resources

New to the currency market? Want a better understanding of the different approaches for trading? Start by downloading and reviewing the DailyFX Beginners Guide.

Are you looking to improve your trading approach? Review the ‘Traits of a Successful Trader’ series on how to effectively use leverage along with other best practices that any trader can follow.

--- Written by David Song, Currency Analyst

Follow me on Twitter at @DavidJSong.