Trading the News: U.S. Non-Farm Payrolls (NFP)

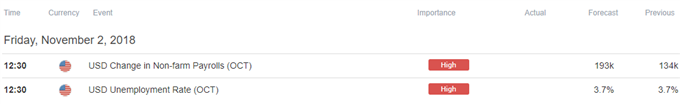

The U.S. Non-Farm Payrolls (NFP) report may curb the recent rebound in EUR/USD as employment is projected to increase 193K in October.

Signs of stronger job/wage growth may heighten the appeal of the greenback as it boosts the outlook for growth and inflation, and it seems as though the Federal Reserve will continue to carry out its hiking-cycle over the coming months as the central bank largely achieves its dual mandate for full-employment and price stability.

In turn, a positive development may encourage the Federal Open Market Committee (FOMC) to implement higher borrowing-costs over the coming months, but another series of lackluster data prints may spark a bearish reaction in the dollar as ‘trade policy developments remained a source of uncertainty for the outlook for domestic growth and inflation.’ Sign up and join DailyFX Currency Analyst David Song LIVE for an opportunity to discuss potential trade setups.

Impact that the U.S. NFP report has had on EUR/USD during the previous release

| Period | Data Released | Estimate | Actual | Pips Change | Pips Change |

|---|---|---|---|---|---|

SEP 2018 | 10/05/2018 12:30:00 GMT | 185K | 134K | +27 | +15 |

September 2018 U.S. Non-Farm Payrolls (NFP)

The U.S. economy added 134K jobs in September, with the jobless rate narrowing to 3.7% from 3.9% per annum in August. A deeper look at the report showed the Labor Force Participation Rate holding steady at 62.7% for the second month, while Average Hourly Earnings narrowed to 2.8% from 2.9% during the same period.

The U.S. dollar struggled to hold its ground following the mixed data prints, with EUR/USD quickly climbing back above the 1.1500 handle to close the day at 1.1519. Review the DailyFX Advanced Guide for Trading the News to learn our 8 step strategy.

EUR/USD Daily Chart

- Broader outlook for EUR/USD remains mired by the series of failed attempts to break/close above the 1.1810 (61.8% retracement) hurdle, but the recent decline in the exchange rate appears to have stalled ahead of the 2018-low (1.1301), with recent developments in the Relative Strength Index (RSI) warning of a larger rebound in the exchange rate as the oscillator reverses course ahead of oversold territory and breaks out of the bearish formation carried over from late-September.

- In turn, the lack of momentum to clear the 1.1290 (61.8% expansion) hurdle may spur a move back above the 1.1390 (61.8% retracement) to 1.1400 (50% expansion) region, with the next topside region of interest coming in around 1.1510 (38.2% expansion).

For more in-depth analysis, check out the Q4 Forecast for EUR/USD

Additional Trading Resources

New to the currency market? Want a better understanding of the different approaches for trading? Start by downloading and reviewing the DailyFX Beginners Guide !

Are you looking to improve your trading approach? Review the ‘Traits of a Successful Trader’ series on how to effectively use leverage along with other best practices that any trader can follow.

--- Written by David Song, Currency Analyst

Follow me on Twitter at @DavidJSong.