- Reserve Bank of New Zealand (RBNZ) to Keep Cash Rate at Record-Low of 1.75%.

- Will Governor Graeme Wheeler & Co. Toughen the Verbal Intervention?

- Sign Up & Join DailyFX Current Strategist John Kicklighter LIVE to Cover the RBNZ Meeting.

Trading the News: Reserve Bank of New Zealand (RBNZ) Interest Rate Decision

The Reserve Bank of New Zealand (RBNZ) interest rate decision may yield a limited market reaction as the central bank retain the record-low cash rate, but the accompanying policy statement may drag on NZD/USD should Governor Graeme Wheeler and Co. toughen the verbal intervention on the local currency.

Why Is This Event Important:

The RBNZ may stick to the sidelines beyond Governor Wheeler’s departure in September as Deputy Governor Grant Spencer takes the helm for the next six-months. In turn, the central bank may continue to endorse a wait-and-see approach throughout the remainder of the year as 2Q Employment unexpectedly contracts 0.1%, while the Consumer Price Index (CPI) slows more-than-expected during the same period. At the same time, the RBNZ may follow the Reserve Bank of Australia (RBA) and toughen the verbal intervention on the local currency as ‘a lower New Zealand dollar would help rebalance the growth outlook towards the tradables sector.’

However, the fresh remarks may once again spark a bullish reaction in NZD/USD if the RBNZ continues to soften its dovish tone and shows a greater willingness to gradually move away from its easing-cycle.

Impact that the RBNZ rate decision has had on NZD/USD during the last meeting

| Period | Data Released | Estimate | Actual | Pips Change | Pips Change |

|---|---|---|---|---|---|

JUN 2017 | 06/21/2017 21:00:00 GMT | 1.75% | 1.75% | +25 | +50 |

June 2017 Reserve Bank of New Zealand (RBNZ) Interest Rate Decision

NZD/USD 15-Minute

The Reserve Bank of New Zealand (RBNZ) kept the official cash rate at the record-low of 1.75%, but the central bank appeared to be softening its dovish tone, with Governor Graeme Wheeler and Co. noting that ‘the growth outlook remains positive, supported by accommodative monetary policy, strong population growth, and high terms of trade.’ The RBNZ went onto say that the ‘recent changes announced in Budget 2017 should support the outlook for growth,’ but it seems as though the central bank is in no rush to normalize monetary policy as ‘numerous uncertainties remain and policy may need to adjust accordingly.’ The New Zealand dollar gained ground followed the upbeat tone, with NZD/USD climbing above the 0.7250 region to end the day at 0.7265.

How To Trade This Event Risk(Video)

Bearish NZD Trade: RBNZ Tames Rate Expectations & Toughens Verbal Intervention

- Need a red five-minute candle following the rate decision to consider a short NZD/USD position.

- If market reaction favors a bearish kiwi position, sell NZD/USD with two separate lots.

- Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward.

- Move stop to breakeven on remaining position once initial target is met, set reasonable limit.

Bullish NZD Trade: Governor Wheeler & Co. Endorse Improved Outlook

- Need a green, five-minute candle to consider a long NZD/USD position.

- Carry out the same setup as the bearish kiwi position, just in the opposite direction.

Key Levels For NZD/USD

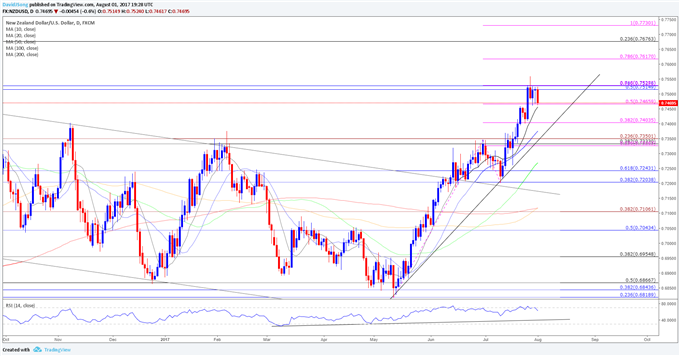

NZD/USD Daily Chart

DailyFX 3Q Forecasts Are Now Available

- NZD/USD stands at risk for further losses as it carves a series of lower highs & lows and dips below the former-resistance zone around 0.7330 (38.2% retracement) to 0.7350 (23.6% expansion).

- Keeping a close eye on the Relative Strength Index (RSI) as it comes up against trendline support; failure to preserve the bullish formation from March may open up the downside targets for NZD/USD as the oscillator exhibits a similar dynamic as price.

- Next downside region of interest comes in around 0.7240 (61.8% retracement) 0.7280 (61.8% retracement) followed by the Fibonacci overlap around 0.7190 (50% retracement) to 0.7200 (38.2% retracement).

- Interim Resistance: 0.7730 (100% expansion) to 0.7744 (April 2015-high)

- Interim Support: 0.7190 (50% retracement) to 0.7200 (38.2% retracement)

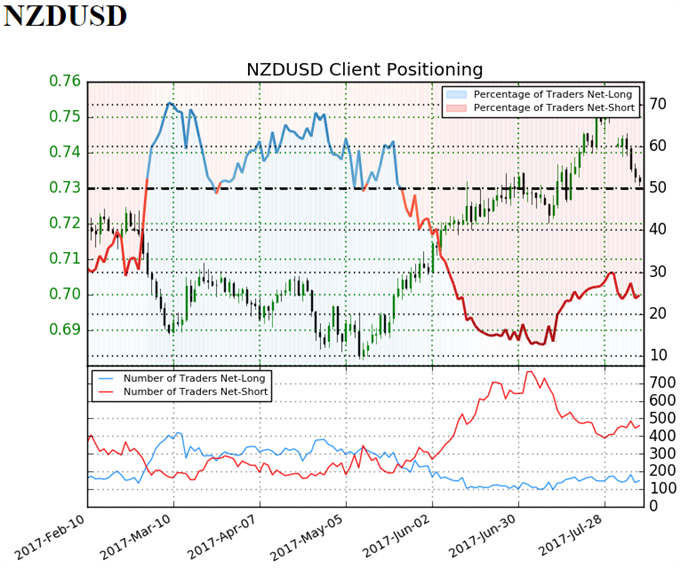

NZD/USD Retail Sentiment

Track Retail Sentiment with the New Gauge Developed by DailyFX Based on Trader Positioning

Retail trader data shows 24.5% of traders are net-long NZD/USD with the ratio of traders short to long at 3.08 to 1. In fact, traders have remained net-short since May 24 when NZD/USD traded near 0.68562; price has moved 6.8% higher since then. The number of traders net-long is 18.1% lower than yesterday and 10.8% lower from last week, while the number of traders net-short is 7.8% lower than yesterday and 8.3% higher from last week.

--- Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.