- Australia Employment to Increase for Fourth Consecutive Month.

- Unemployment Rate to Advance to 5.8%- Highest Reading Since February.

For more updates, sign up for David's e-mail distribution list.

Trading the News: Australia Employment Change

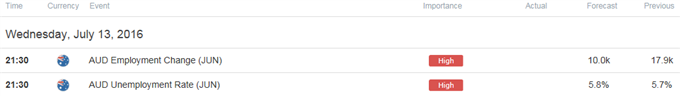

Despite forecasts for an uptick in Australia’s jobless rate, another 10.0K expansion in employment may boost the appeal of the Aussie and spur a further advance in AUD/USD as it dampens market speculation for additional monetary support.

What’s Expected:

Click Here for the DailyFX Calendar

Why Is This Event Important:

The Reserve Bank of Australia (RBA) may stick to the sidelines throughout the remainder of the year as the central bank anticipates ‘a modest pace of expansion in employment in the near term,’ and Governor Glenn Stevens may continue to endorse a wait-and-see approach at the next policy meeting on August 2 as the previous rate-cuts work their way through the real economy.

Expectations: Bullish Argument/Scenario

| Release | Expected | Actual |

|---|---|---|

| NAB Business Confidence (JUN) | -- | 6 |

| AiG Performance of Construction (JUN) | -- | 53.2 |

| AiG Performance of Manufacturing (JUN) | -- | 51.8 |

Improved confidence accompanied by the pickup in business outputs may foster a better-than-expected employment report, and a further improvement in labor market dynamics may encourage the RBA to soft its dovish tone for monetary policy as it instills an improved outlook for growth and inflation.

Risk: Bearish Argument/Scenario

| Release | Expected | Actual |

|---|---|---|

| Retail sales (MoM) (MAY) | 0.3% | 0.2% |

| Trade Balance (MAY) | -1.700B | -2.218M |

| Private Sector Credit (MoM) (MAY) | 0.5% | 0.4% |

However, easing demand from home and abroad may prompt Australian firms to scale back on hiring, and a dismal development may produce near-term headwinds for the Aussie as it puts increased pressure on the RBA to further embark on its easing cycle.

How To Trade This Event Risk(Video)

Bullish AUD Trade: Employment Climbs 10.0K or Greater

- Need green, five-minute candle following the print for a long AUD/USD trade.

- If market reaction favors a bullish aussie position, buy AUD/USD with two separate lots.

- Set stop at the near-by swing low/reasonable distance from entry; look for at least 1:1 risk-to-reward.

- Move stop to breakeven on remaining position once initial target is met, set reasonable limit.

Bearish AUD Trade: Labor Report Falls Short of Market Expectations

- Need red, five-minute candle to consider a short AUD/USD position.

- Carry out the same setup as the bullish aussie trade, just in the opposite direction.

Potential Price Targets For The Release

AUD/USD Daily

- AUD/USD stands at risk for a larger recovery as price & the Relative Strength Index (RSI) preserve the bullish formations carried over from the previous month, with a closing price above 0.7650 (78.6% retracement) raising the risk for run a the 2016 high (0.7834).

- Key Resistance: 0.7848 (June 2015 high) to 0.7860 (61.8% expansion)

- Key Support: 0.6826 (2016 low) to 0.6830 (161.8% expansion)

Check out the short-term technical levels that matter for AUD/USD heading into the report!

Avoid the pitfalls of trading by steering clear of classic mistakes. Review these principles in the "Traits of Successful Traders" series.

Impact that the Australia Employment report has had on AUD during the last release

| Period | Data Released | Estimate | Actual | Pips Change | Pips Change |

|---|---|---|---|---|---|

| MAY 2016 | 06/16/2016 01:30 GMT | 15.0K | 17.9K | -30 | -61 |

May 2016 Australia Employment Change

AUD/USD 5-Minute Chart

The Australian economy added another 17.9K jobs in May following a revised 0.8K expansion the month prior, while the unemployment rate held steady at an annualized 5.7% for the third consecutive month. A deeper look at the report showed part-time positions increased another 17.9K after advancing 19.1K in April, while full-time employment held flat in May after contracting 18.2K during the prior month. Despite the better-than-expected headline print, the spike higher in AUD/USD was short-lived, with the pair slipping below the 0.7400 handle to end the day at 0.7361.

Get our top trading opportunities of 2016 HERE

Read More:

DAX: Upside Carnage Continues, Major Price Zone Next Stop

WTI Crude Oil Price Forecast: Bearish Price Channel Favors Downside Bias

COT-Unchartered Waters for Gold and Silver Positioning

USD/CAD is Fertile Ground; Watch Daily 8-EMA in GBP-crosses

--- Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.