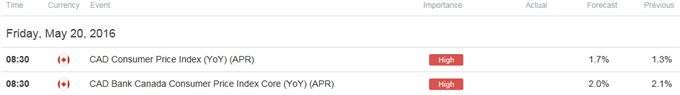

- Canada Consumer Price Index (CPI) to Rise for First Time Since January.

- Core Rate of Inflation to Slow for Second Time in 2016.

For more updates, sign up for David's e-mail distribution list.

Trading the News: Canada Consumer Price Index (CPI)

Despite forecasts for a rebound in Canada’s Consumer Price Index (CPI), a marked slowdown in the core rate of inflation may drag on the loonie and spark a further advance in USD/CAD as it dampens interest-rate expectations.

What’s Expected:

Click Here for the DailyFX Calendar

Why Is This Event Important:

Even though the Bank of Canada (BoC) has turned upbeat on the economy in 2016, Governor Stephen Poloz and Co. may opt to retain the accommodative policy stance for an extended period as the central bank continues to highlight the persistent slack in the real economy.

Expectations: Bullish Argument/Scenario

| Release | Expected | Actual |

|---|---|---|

| Existing Home Sales (MoM) (APR) | -- | 3.1% |

| Raw Materials Price Index (MoM) (MAR) | 3.7% | 4.5% |

| Gross Domestic Product (Annualized) (4Q) | 0.0% | 0.8% |

Signs of a stronger-than-expected recovery paired higher input costs may boost consumer prices, and a pickup in the headline as well as the core rate of inflation may boost the appeal of the Canadian dollar as it puts increased pressure on the BoC to normalize monetary policy sooner rather than later.

Risk: Bearish Argument/Scenario

| Release | Expected | Actual |

|---|---|---|

| Wholesale Trade Sales (MoM) (MAR) | -0.5% | -1.0% |

| Net Change in Employment (APR) | 1.0K | -2.1K |

| International Merchandise Trade (MAR) | -1.40B | -3.41B |

However, Canadian firms may offer discounted prices amid easing demand at home and abroad, and a soft inflation report may produce near-term headwinds for the loonie as it fuels speculation for additional monetary support.

How To Trade This Event Risk(Video)

Bullish CAD Trade: Headline & Core Rate of Inflation Exceed Market Forecast

- Need to see red, five-minute candle following the release to consider a short trade on USD/CAD.

- If market reaction favors a bullish loonie trade, sell USD/CAD with two separate position.

- Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward.

- Move stop to entry on remaining position once initial target is hit; set reasonable limit.

Bearish CAD Trade: Canada CPI Report Disappoints

- Need green, five-minute candle to favor a long USD/CAD trade.

- Implement same setup as the bullish Canadian dollar trade, just in reverse.

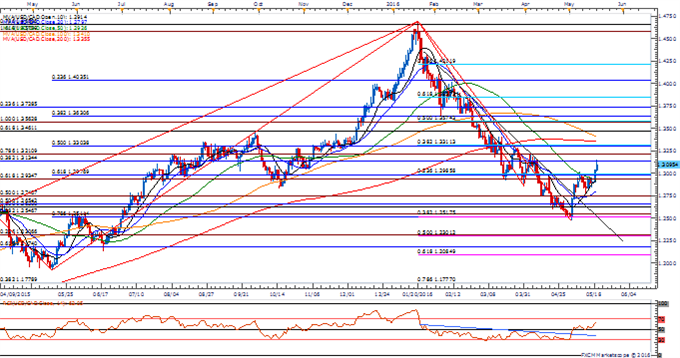

Potential Price Targets For The Release

USD/CAD Daily

Chart - Created Using FXCM Marketscope 2.0

- May see the long-term bull trend in USD/CAD reassert itself as the pair breaks out of the bearish formation from earlier this year, with the Relative Strength Index (RSI) following suit.

- Key Resistance: 1.3560 (100% expansion) to 1.3630 (38.2% retracement)

- Key Support: 1.2510 (78.6% retracement) to 1.2520 (38.2% expansion)

Avoid the pitfalls of trading by steering clear of classic mistakes. Review these principles in the "Traits of Successful Traders" series.

Impact that Canada Consumer Price Index (CPI) has had on USD/CAD during the last release

| Period | Data Released | Estimate | Actual | Pips Change | Pips Change |

|---|---|---|---|---|---|

MAR 2016 | 04/22/2016 12:30 GMT | 1.2% | 1.3% | -58 | -51 |

March 2016 Canada Consumer Price Index (CPI)

Canada’s Consumer Price Index (CPI) slowed to an annualized 1.3% from 1.4% in February, while the core rate of inflation unexpectedly advanced to 2.1% from 1.9% during the same period amid forecasts for a 1.7% print. A deeper look at the report showed prices for clothing & footwear increased 4.2% to lead the advance, with transportation costs rebound 1.3% while food costs narrowed 0.3% in March. The stronger-than-expected reading for both the headline & core rate of inflation propped up the Canadian dollar, with USD/CAD slipping below the 1.2700 handle to end the day at 1.2665.

Get our top trading opportunities of 2016 HERE

Check out FXCM’s Forex Trading Contest

Read More:

Gold Bulls Look to CPI, Fed Minutes for Solace

DailyFX Technical Focus: Short Term S&P and Gold Analysis

USD/CAD Technical Analysis: Time For Bulls To Prove Their Worth

--- Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.