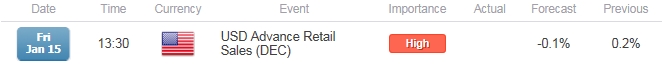

- U.S. Advance Retail Sales to Decline for First Time Since September.

- Household Spending to Contract for Seventh Time in 2015.

For more updates, sign up for David's e-mail distribution list.

Trading the News: U.S. Advance Retail Sales

A 0.1% contraction in U.S. Retail Sales may drag on the greenback and spur a near-term advance in EUR/USD as it undermines the Fed’s scope to further normalize monetary in the first-half of 2016.

What’s Expected:

Click Here for the DailyFX Calendar

Why Is This Event Important:

Even though the Federal Open Market Committee (FOMC) remains on course to implement higher borrowing-costs over the coming months, a marked slowdown in private-sector consumption, one of the leading drivers of growth and inflation, may encourage the central bank to endorse a wait-and-see approach at the January 27 interest rate decision as the board struggles to achieve the 2% target for price growth.

Expectations: Bearish Argument/Scenario

| Release | Expected | Actual |

|---|---|---|

| Consumer Credit (NOV) | $18.000B | $13.951B |

| Wholesale Trade Sales (NOV) | -0.1% | -0.3% |

| Average Hourly Earnings (YoY) (DEC) | 2.7% | 2.5% |

Subdued wage growth accompanied by the slowdown in private-sector lending may drag on household spending, and a dismal retail sales figure may push the Fed to adopt a more cautious outlook for the region as it points to a slowing recovery.

Risk: Bullish Argument/Scenario

| Release | Expected | Actual |

|---|---|---|

| Labor Market Conditions Index (DEC) | 0.4 | 2.9 |

| Non-Farm Payrolls (DEC) | 200K | 292K |

| Consumer Confidence (DEC) | 93.5 | 96.5 |

However, improved confidence paired with the ongoing rise in job growth may help to boost consumption, and a positive development may put increased pressure on the FOMC to implement higher borrowing-costs especially as the region approaches ‘full-employment.’

Join DailyFX on Demand for Real-Time Updates on the DailyFX Speculative Sentiment Index!

How To Trade This Event Risk(Video)

Bearish USD Trade: Retail Sales Slips 0.1% or Greater in December

- Need green, five-minute candle following the sales report to consider a long EUR/USD trade.

- If market reaction favors a bearish dollar trade, buy EUR/USD with two separate position.

- Set stop at the near-by swing low/reasonable distance from entry; look for at least 1:1 risk-to-reward.

- Move stop to entry on remaining position once initial target is hit; set reasonable limit.

Bullish USD Trade: U.S. Household Consumption Beats Market Expectations

- Need red, five-minute candle to favor a short EUR/USD trade.

- Implement same setup as the bearish dollar trade, just in opposite direction.

Potential Price Targets For The Release

EUR/USD Daily

Chart - Created Using FXCM Marketscope 2.0

- The failed attempt to break the March low (1.0461) may spur a larger correction in EUR/USD as preserves the opening range and remains stuck within a wedge/triangle formation but, the long-term outlook remains tilted to the downside amid the deviating paths for monetary policy.

- The DailyFX Speculative Sentiment Index (SSI) shows retail crowd flipped net-short EUR/USD on January 6, but the ratio remains off of recent extremes as it narrows to -1.13, with 47% of traders now long.

- Interim Resistance: 1.1052 (November high) to 1.1090 (50% retracement)

- Interim Support: Interim Support: 1.0380 (78.6% expansion) to 1.0410 (61.8% expansion)

Impact that the U.S. Retail Sales report has had on EUR/USD during the previous month

| Period | Data Released | Estimate | Actual | Pips Change | Pips Change |

|---|---|---|---|---|---|

NOV 2015 | 12/11/2015 13:30 GMT | 0.3% | 0.2% | +38 | +35 |

November 2015 U.S. Advance Retail Sales

U.S. Retail Sales continued to disappoint in December, with household spending increasing 0.2% after expanding 0.1% during the month prior. A deeper look at the report showed demand for auto vehicle/parts slipped another 0.4% in December, with gasoline receipts contraction 0.8% as well, while discretionary spending on clothing increased 0.8% following the 0.5% contraction in September. Even though the Fed anticipates a stronger recovery and stays on course to normalize monetary policy, the mixed data prints coming out of the region may spur a broader dissent within the committee as Chair Janet Yellen appears to be in no rush to implement higher borrowing-costs. Despite the limited market reaction to the retail sales report, the greenback struggled to hold its ground throughout the North American trade, with EUR/USD closing the North American session at 1.0984.

Read More:

NZDUSD Testing Slope Support- Rebound to Offer Short Entries

The Pain of Tolerance is Withdrawal: It’s a Different World without QE

Price & Time: USDJPY - Flirting With a Mid-1990’s Redux

USD/CAD Technical Analysis: Multiple Major Targets Hit This Morning

Avoid the pitfalls of trading by steering clear of classic mistakes. Review these principles in the "Traits of Successful Traders" series.

--- Written by David Song, Currency Analyst and Shuyang Ren

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.

Trade Alongsidethe DailyFX Team on DailyFX on Demand