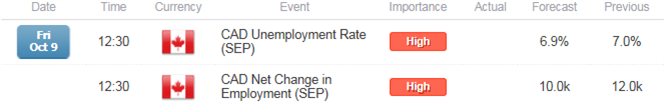

- Canada Employment Expected to Increase for Third Consecutive Month.

- Jobless Rate to Hold at 7.0%- Highest Reading for 2015.

For more updates, sign up for David's e-mail distribution list.

Trading the News: Canada Net Change in Employment

Another 10.0K expansion in Canada Employment may boost the appeal of the loonie and spur a further decline in USD/CAD as it boosts the outlook for growth and inflation.

What’s Expected:

Click Here for the DailyFX Calendar

Why Is This Event Important:

Even though Canada remains stuck in a technical recession, data prints pointing to a more sustainable recovery may encourage the Bank of Canada (BoC) to move away from its easing cycle, and the dollar-loonie may face a larger correction in the days ahead especially as the Fed appears to be in no rush to remove its zero-interest rate policy (ZIRP).

Expectations: Bullish Argument/Scenario

| Release | Expected | Actual |

|---|---|---|

| Existing Home Sales (MoM) (AUG) | -- | 0.3% |

| Gross Domestic Product (MoM) (JUL) | 0.2% | 0.3% |

| Housing Starts (AUG) | 190.5K | 216.9K |

The pickup in private-sector activity may encourage firms to expand their labor force, and a further expansion in hiring may spark a bullish reaction in the Canadian dollar as it curbs the BoC’s scope to introduce additional rate cuts.

Risk: Bearish Argument/Scenario

| Release | Expected | Actual |

|---|---|---|

| Ivey Purchasing Manager Index (SEP) | 54.0 | 53.7 |

| International Merchandise Trade (AUG) | -1.20B | -2.53B |

| Retail Sales (MoM) (JUL) | 0.7% | 0.5% |

Nevertheless, waning demand from home and abroad may drag on job growth, and an dismal employment report may trigger a near-term bottoming process in the exchange rate as it raises the risk of seeing lower borrowing-costs in Canada.

How To Trade This Event Risk(Video)

Bullish CAD Trade: Employment Increases Another 10.0K or Greater

- Need red, five-minute candle following the report for a potential short USD/CAD trade.

- If market reaction favors a bullish loonie trade, sell USD/CAD with two separate position.

- Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward.

- Move stop to breakeven on remaining position once initial target is met, set reasonable limit.

Bullish CAD Trade: Canada Labor Report Falls Short of Market Forecast

- Need green, five-minute candle to consider a long USD/CAD position.

- Carry out the same setup as the bullish Canadian dollar trade, just in the opposite direction.

Read More:

USD on Weaker Footing versus GBP, JPY, NZD after Positioning Shifts

Price & Time: Timing Relationships Suggest 4th Quarter Key For Crude

Potential Price Targets For The Release

USD/CAD Daily

Chart - Created Using FXCM Marketscope 2.0

- Downside risk remains for USD/CAD as the Relative Strength Index (RSI) fails to retain the bullish formation from back in April; failure to hold above the August low (1.2951) may open up the downside targets.

- DailyFX Speculative Sentiment Index (SSI) shows the retail crowd has flipped net-long USD/CAD on October 2, with the ratio climbing to +1.34 as 57% of traders are now long.

- Interim Resistance: 1.3440 (50% expansion) to 1.3460 (61.8% retracement)

- Interim Support: 1.2930 (61.8% expansion) to 1.2950 (38.2% retracement)

Join DailyFX on Demand for Real-Time Updates on the DailyFX Speculative Sentiment Index!

Impact that Canada Employment Change has had on CAD during the last release

| Period | Data Released | Estimate | Actual | Pips Change | Pips Change |

|---|---|---|---|---|---|

AUG 2015 | 09/04/2015 12:30 GMT | -5.0K | 12.0K | +13 | +66 |

AugustCanada Employment Change

Canada unexpectedly added another 12.0K jobs in August following the 6.6K expansion the month prior. At the same time, the unemployment rate rose to an annualized rate of 7.0% from 6.8% as discouraged workers returned to the labor force, with the participation rate climbing to 65.9% from 65.7% in July. The better-than-expected employment report may highlight an improved outlook for the region as the Bank of Canada (BoC) sees the region emerging from the technical recession later this year, and we may see Governor Stephen Poloz endorse a wait-and-see approach throughout the remainder of the year as the central bank head turns increasingly upbeat on the economy. Despite the better-than-expected job increase, the bullish reaction in the Canadian dollar was short-lived, with USD/CAD climbing above the 1.3250 region to end the day at 1.3276.

--- Written by David Song, Currency Analyst and Shuyang Ren

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.

Trade Alongsidethe DailyFX Team on DailyFX on Demand

Looking to use the DailyFX Trade Signals LIVE? Check out Mirror Trader.

New to FX? Watch this Video

Join us to discuss the outlook for the major currencies on the DailyFXForums