- European Central Bank (ECB) to Keep Rates on Hold, Retain EUR 60B QE Program.

- Will ECB President Mario Draghi Endorse Expansion/Extension of Asset-Purchases?

For more updates, sign up for David's e-mail distribution list.

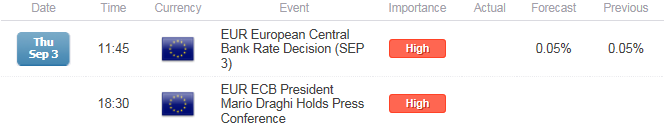

Trading the News: European Central Bank (ECB) Interest Rate Decision

Even though the European Central Bank (ECB) is widely expected to retain its current policy in September, the fresh updates coming out of the Governing Council may trigger a selloff in EUR/USD should the committee show a greater willingness to expand/extend its quantitative easing (QE) program.

What’s Expected:

Click Here for the DailyFX Calendar

Why Is This Event Important:Dovish rhetoric accompanied by a downward revision in the ECB’s growth & inflation forecast is likely to dampen the appeal of the Euro, and central bank President Mario Draghi may talk up bets for additional monetary support in an effort to further insulate the fragile recovery in Europe.

Expectations: Bearish Argument/Scenario

| Release | Expected | Actual |

|---|---|---|

| Trade Balance s.a. (JUN) | 23.1B | 21.9B |

| Gross Domestic Product s.a. (YoY) (2Q A) | 1.3% | 1.2% |

| Retail Sales (MoM) (JUN) | -0.2% | -0.6% |

The ECB may take additional steps to shore up the ailing economy as it struggles to achieve its one and only mandate for price stability, and bets for more easing may lead EUR/USD to give back the rebound from the previous month amid the growing deviation in the policy outlook.

Risk: Bullish Argument/Scenario

| Release | Expected | Actual |

|---|---|---|

| Unemployment Rate (JUL) | 11.1% | 10.9% |

| Consumer Price Index Core (YoY) (AUG A) | 0.9% | 1.0% |

| Economic Confidence (AUG) | 103.8 | 104.2 |

Nevertheless, we may get more of the same from the ECB as the non-standard measures work through the real economy, and the near-term bound in EUR/USD may gather pace in September should the central bank endorse a wait-and-see approach.

Join DailyFX on Demand for Coverage of the Entire ECB Rate Decision!

How To Trade This Event Risk(Video)

Bearish EUR Trade: ECB Shows Greater Willingness for Larger/Longer QE Program

- Need red, five-minute candle following the policy announcement to consider a short EUR/USD trade.

- If market reaction favors a bearish Euro trade, sell EUR/USD with two separate position.

- Set stop at the near-by swing high/reasonable distance from cost; need at least 1:1 risk-to-reward.

- Move stop to entry on remaining position once initial target is met, set reasonable limit.

Bullish EUR Trade: President Draghi Continues to Endorse Wait-and-See Approach

- Need green, five-minute candle to favor a long EUR/USD trade.

- Implement same strategy as the bearish euro trade, just in the opposite direction.

Read More:

Retail FX Remains Short EUR/USD Ahead of ECB- GBP/USD Eyes June Low

AUDNZD: Rinse & Repeat- Reversal Scalp Back in Play Ahead of GDP

Potential Price Targets For The Release

EURUSD Daily

Chart - Created Using FXCM Marketscope 2.0

- Despite expectations for a greater deviation in the policy outlook, need a break of the near-term bullish trends in price & RSI to favor a further decline in EUR/USD.

- DailyFX Speculative Sentiment Index (SSI) shows the retail crowd remains net-short EUR/USD since March 9, but the ratio remains off of recent extremes as it sits at -1.46, with 41% of traders long.

- Interim Resistance: 1.1760 (61.8% retracement) to 1.1810 (38.2% retracement)

- Interim Support: Interim Support: 1.0790 (50% expansion) to 1.0800 (23.6% expansion)

Impact that the ECB rate decision has had on EUR/USD during the last meeting

| Period | Data Released | Estimate | Actual | Pips Change | Pips Change |

|---|---|---|---|---|---|

| JUL 2015 | 07/16/2015 11:45 & 12:30 GMT | 0.05% | 0.05% | +5 | -1 |

July 2015 European Central Bank Interest Rate Decision

The European Central Bank (ECB) stuck to its current policy in July, with the Governing Council keeping the benchmark interest rate at the record-low of 0.05%, while preserving its pledge to ‘fully implement’ the quantitative easing program. Despite the ongoing concerns surrounding the Greek crisis, the ECB may keep its asset-purchase program capped at EUR 60B/month as the central bank sees a ‘moderate’ recovery in Europe. The bullish market reaction to the ECB rate decision was short-lived, with EUR/USD falling back from a session high of 1.0925 and closing the day at 1.0869.

--- Written by David Song, Currency Analyst and Shuyang Ren

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.

Trade Alongsidethe DailyFX Team on DailyFX on Demand

Looking to use the DailyFX Trade Signals LIVE? Check out Mirror Trader.

New to FX? Watch this Video

Join us to discuss the outlook for the major currencies on the DailyFXForums