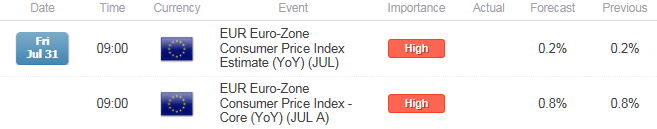

- Euro-Zone Consumer Price Index (CPI) to Expand Another 0.2% in July.

- Core Inflation to Hold Steady at Annualized 0.8% for Second Consecutive Month.

For more updates, sign up for David's e-mail distribution list.

Trading the News: Euro-Zone Consumer Price Index (CPI)

The Euro-Zone’s Consumer Price Index (CPI) may spur a bullish reaction in EUR/USD as sticky price growth in the monetary union dampens the European Central Bank’s (ECB) scope to implement more non-standard measures.

What’s Expected:

Click Here for the DailyFX Calendar

Why Is This Event Important:

Even though the ECB retains its pledge to ‘fully implement’ its quantitative easing (QE) program, the diminishing threat for deflation may encourage central bank President Mario Draghi to adopt a more upbeat tone over the coming months, and the Governing Council may start to discuss a potential exit strategy going into 2016 amid signs of a more sustainable recovery in the euro-area.

Expectations: Bullish Argument/Scenario

| Release | Expected | Actual |

|---|---|---|

| M3 Money Supply (3M) (JUN) | 5.1% | 5.1% |

| Retail Sales (MoM) (MAY) | 0.1% | 0.2% |

| Construction Output (MoM) (MAY) | -- | 0.3% |

Increased consumption paired with the pickup in private-sector credit may encourage faster price growth across the euro-area, and an unexpected expansion in the CPI may heighten the appeal of the single currency as the region gets on a more sustainable path.

Risk: Bearish Argument/Scenario

| Release | Expected | Actual |

|---|---|---|

| Consumer Confidence (JUL A) | -5.8 | -7.1 |

| Producer Price Index (YoY) (MAY) | -2.0% | -2.0% |

| Unemployment Rate (MAY) | 11.1% | 11.1% |

However, European firms may continue to offer discounted prices amid high unemployment along with lower input costs, and a dismal inflation report may produce further headwinds for the euro as the ECB retains a very dovish outlook for monetary policy.

Join DailyFX on Demand for Real-Time SSI Updates!

How To Trade This Event Risk(Video)

Bullish EUR Trade: CPI Highlights Sticky Price Growth

- Need green, five-minute candle following the release to consider a long EUR/USD trade.

- If market reaction favors a bullish Euro trade, buy EUR/USD with two separate position.

- Set stop at the near-by swing low/reasonable distance from entry; look for at least 1:1 risk-to-reward.

- Move stop to entry on remaining position once initial target is hit, set reasonable limit.

Bearish EUR Trade: Euro-Zone Inflation Exceeds Market Forecast

- Need red, five-minute candle to favor a short EUR/USD trade.

- Implement same setup as the bullish Euro trade, just in opposite direction.

Read More:

Price & Time: Big Moment For Kiwi

Dollar Forecast Improves, Indicator Shows it May Rally Across the Board

Potential Price Targets For The Release

EURUSD Daily

Chart - Created Using FXCM Marketscope 2.0

- Failure to hold above the Fibonacci overlap around 1.0970 (38.2% expansion) to 1.0990 (50% retracement) raises the risk for a further decline in EUR/USD as the pair continues to search for support, with the July low (1.0807) on the radar.

- DailyFX Speculative Sentiment Index (SSI) shows the retail crowd remains net-short EUR/USD since March 9, but the ratio continues to narrow ahead of August as it sits at -1.43, with 41% of traders long.

- Interim Resistance: 1.1180 (23.6% expansion) to 1.1210 (61.8% retracement)

- Interim Support: 1.0790 (50% expansion) to 1.0800 (23.6% expansion)

Impact that the Euro-Zone CPI report has had on EUR during the last release

| Period | Data Released | Estimate | Actual | Pips Change | Pips Change |

|---|---|---|---|---|---|

JUN 2015 | 06/30/2015 09:00 GMT | 0.2% | 0.2% | +45 |

June 2015 Euro-Zone Consumer Price Index (CPI)

The Euro-Zone’s Consumer Price Index (CPI) slowed to an annualized rate of 0.2% in June from 0.3% the month prior, while the core rate of inflation also matched market expectations as it slipped to 0.8% from 0.9% during the same period. Despite the slowdown, it looks as though the monetary union is largely moving away from a disinflationary environment after facing negative price growth earlier this year, and the Europe Central Bank (ECB) may turn increasingly upbeat towards the economy as President Mario Draghi sees a moderate recovery in the euro-area. The Euro bounced back following the in-line prints, with EUR/USD working its way above the 1.1200 handle, but the pair struggled to holds its ground during the North American trade as it closed the day at 1.1140

--- Written by David Song, Currency Analyst and Shuyang Ren

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.

Trade Alongsidethe DailyFX Team on DailyFX on Demand

Looking to use the DailyFX Trade Signals LIVE? Check out Mirror Trader.

New to FX? Watch this Video

Join us to discuss the outlook for the major currencies on the DailyFXForums