Talking Points

- NZD/USD tests internal trendline

- EUR/USD fails at 50-day moving average

- S&P 500 rebounds off key Gann level

Get real time volume on your charts for free. Click HERE

Foreign Exchange Price & Time at a Glance:

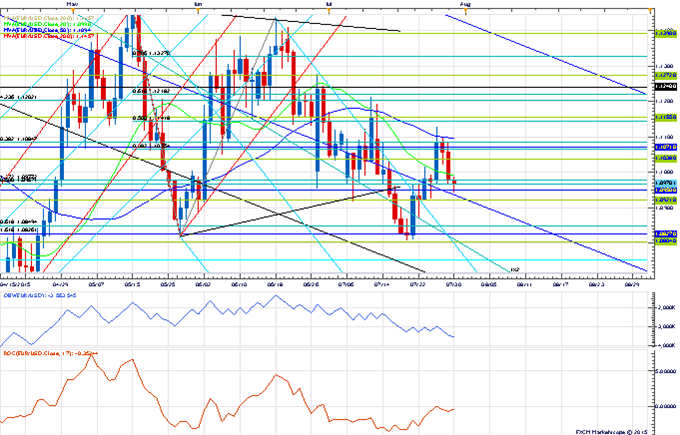

Price & Time Analysis: EUR/USD

ChartPrepared by Kristian Kerr

- EUR/USD failed earlier this week near the 50-day moving average in the 1.1100 area

- Our near-term trend bias is higher in the exchange rate while above 1.0920

- A daily close above 1.1100 is needed to re-instill upside mometum into the euro

- A very minor turn window is seen tomorrow

- A close back below1.0920 would turn us negative again on EUR/USD

EUR/USD Strategy: Square.

| Instrument | Support 2 | Support 1 | Spot | Resistance 1 | Resistance 2 |

|---|---|---|---|---|---|

| EUR/USD | 1.0870 | *1.0920 | 1.0965 | 1.1040 | *1.1100 |

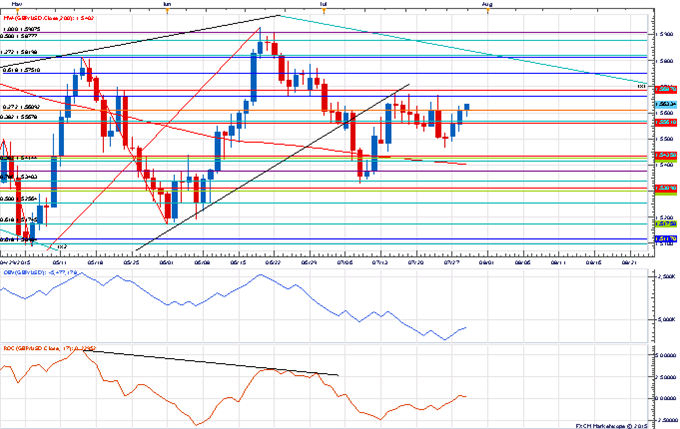

Price & Time Analysis: S&P 500

ChartPrepared by Kristian Kerr

- S&P 500 found support earlier this week at the 2nd square root relationship of the year’s low near 2065

- Our near-term trend bias is positive while above this level

- Immediate resistance is seen around 2108 ahead of the all-time high

- A minor turn window is eyed here

- A daily close below 2065 would turn us negative on the index

S&P 500 Strategy: Like buying on weakness against 2065.

| Instrument | Support 2 | Support 1 | Spot | Resistance 1 | Resistance 2 |

|---|---|---|---|---|---|

| S&P 500 | *2065 | 2100 | 2105 | 2108 | *2135 |

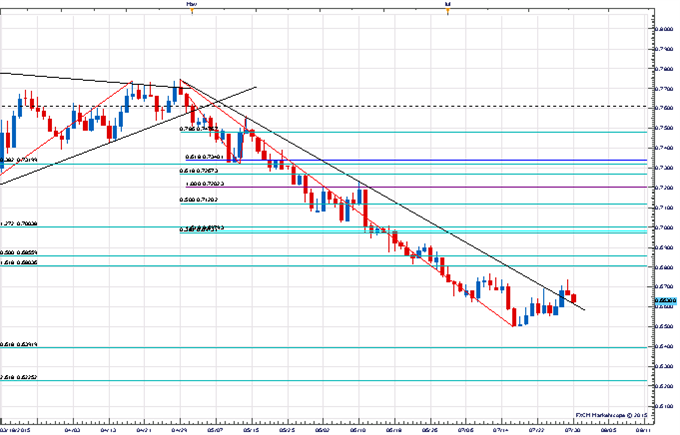

Focus Chart of the Day: NZD/USD

NZD/USD has turned down again on further reports of lower Chinese demand for milk powder. The failure Wednesday to close above last week’s high around .6700 keeps the Kiwi in a negative position and vulnerable to a downside resumption. The trendline connecting the April/June highs near .6615 is now an important near-term downside pivot with a daily close below this level needed to confirm such a shift lower. The extreme negative sentiment recently recorded on the Daily Sentiment Index (DSI) suggests a more material upside correction should eventually play out in NZD/USD, but perhaps the exchange rate first needs to re-test the recent lows or even visit the 61.8% retracement of the 2009-2011 advance near .6400? A successful hold of .6615 followed by a move through .6700 would signal a more material correction is already starting to unfold.

To receive Kristian’s analysis directly via email, please SIGN UP HERE.

--- Written by Kristian Kerr, Senior Currency Strategist for DailyFX.com

This publication attempts to further explore the concept that mass movements of human psychology, as represented by the financial markets, are subject to the mathematical laws of nature and through the use of various geometric, arithmetic, statistical and cyclical techniques a better understanding of markets and their corresponding movements can be achieved.

To contact Kristian, e-mail instructor@dailyfx.com. Follow me on Twitter @KKerrFX