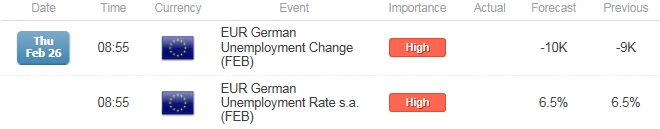

- German Unemployment to Contract for Fifth Consecutive Month in February.

- Jobless Rate to Hold at Record-Low of 6.5% for Second Month.

Trading the News: German Unemployment Change

Another 10K contraction in German Unemployment may encourage a near-term rebound in EUR/USD as it raises the prospects for a stronger recovery in the euro-area.

What’s Expected:

Click Here for the DailyFX Calendar

Why Is This Event Important:

A further improvement in Europe’s largest economy may limit the European Central Bank’s (ECB) scope to further embark on its easing cycle and heighten the appeal of the single currency especially as the member-states take unprecedented steps to mitigate the risk for contagion.

For more updates, sign up for David's e-mail distribution list.

Expectations: Bullish Argument/Scenario

| Release | Expected | Actual |

|---|---|---|

| Gross Domestic Product s.a. (QoQ) (4Q P) | 0.3% | 0.7% |

| Trade Balance (DEC) | 16.0B | 19.1B |

| Factory Orders (MoM) (DEC) | 1.5% | 4.2% |

Greater demand from home and abroad may encourage German firms to further expand their labor force, and a better-than-expected print may spur a bullish reaction in EUR/USD as it raises the outlook for growth and inflation.

Risk: Bearish Argument/Scenario

| Release | Expected | Actual |

|---|---|---|

| IFO Business Climate (FEB) | 107.7 | 106.8 |

| Markit Purchasing Manager Index Manufacturing (FEB P) | 51.5 | 50.9 |

| Industrial Production s.a. (MoM) (DEC) | 0.4% | 0.1% |

However, waning business confidence paired with the slowdown in production may drag on employment, and a dismal labor report may heighten the bearish sentiment surrounding the Euro as ECB President Mario Draghi keeps the door open to further support the monetary union.

How To Trade This Event Risk(Video)

Bullish EUR Trade: Unemployment Contracts 10K or Greater

- Need green, five-minute candle following the print to consider a long EUR/USD trade

- If market reaction favors buying Euro, long EUR/USD with two separate position

- Set stop at the near-by swing low/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit, set reasonable limit

Bearish EUR Trade: German Labor Report Disappoints

- Need red, five-minute candle to favor a short EUR/USD trade

- Implement same setup as the bullish Euro trade, just in opposite direction

Read More:

Price & Time: USD/JPY Waiting On A Catalyst

COT-Small Traders Flip to Short Crude Oil Position

Potential Price Targets For The Release

EUR/USD Daily Chart

Chart - Created Using FXCM Marketscope 2.0

- Long-term outlook remains bearish as the RSI retains the downward trend from 2013, but need a break/close below support to revert back to the approach to ‘sell bounces’ in EUR/USD.

- Interim Resistance: 1.1440 (23.6% retracement) to 1.1480 (78.6% expansion)

- Interim Support: 1.1300 (161.8% expansion) to 1.1310 (100% expansion)

Join DailyFX on Demand for Real-Time Updates on the DailyFX Speculative Sentiment Index!

Impact that the GermanyUnemployment Change has had on EUR during the last release

| Period | Data Released | Estimate | Actual | Pips Change | Pips Change |

|---|---|---|---|---|---|

| JAN 2015 | 01/29/2015 08:55 GMT | -10.0K | -9.0K | +20 | +33 |

January 2015 Germany Unemployment Change

The number of unemployed in Germany contracted 9.0K in January, while the jobless rate narrowed to a record-low of 6.5% from a revised 6.6% the month prior. Despite the ongoing improvement in Europe’s largest economy, the European Central Bank’s (ECB) may continue to highlight a dovish tone for monetary policy as it struggles to achieve its one and only mandate to deliver price stability. Nevertheless, EUR/USD tracked higher following the report, with the pair pushing above the 1.1300 handle to end the day at 1.1326.

--- Written by David Song, Currency Analyst and Shuyang Ren

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link

Trade Alongsidethe DailyFX Team on DailyFX on Demand

Looking to use the DailyFX Trade Signals LIVE? Check out Mirror Trader.

New to FX? Watch this Video

Join us to discuss the outlook for the major currencies on the DailyFXForums