- Yellen to Urge Lawmakers to Act Big

- Euro Awaits Italian Outcome

- Netflix Reports After the Close

Primer: Yellen to Talk up Biden’s Stimulus Plan

The advanced release of incoming US Treasury Secretary Yellen’s speech suggests that Yellen will not want her nomination hearing (scheduled for 1500GMT) to be notably market moving. According to the Wall Street Journal, Yellen will urge lawmakers to “act big” to avert a protracted downturn, adding that without further action, there is a risk of a longer and more painful recession now and thus talking up the President-Elect Joe Biden’s recently announced $1.9trillion stimulus plan. The report by WSJ also comes after recent leaks that Yellen will affirm commitment to market-determined dollar value, making clear that the US does not seek a weak dollar in order to gain a competitive advantage. As such, with much of the statement already announcement, the hearing is unlikely to be market moving.

QUICK TAKE: Equities Climb Higher Ahead of Yellen

Equities: Risk appetite firms ahead of Janet Yellen’s speech, while equity markets are also braced with the upcoming US corporate earnings with Netflix reporting after the closing bell. Nonetheless, US futures are tracking higher ahead of the Wall Street open.

Euro Stoxx 50 Sector Breakdown

Outperformers: Healthcare (2.1%), Consumer Staples (0.5%), Materials (0.4%)Laggards:, Consumer Discretionary (-0.9%), Financials (-0.4%), Real Estate (-0.1%)

US Futures: S&P 500 (0.4%), DJIA (0.5%), Nasdaq 100 (0.6%)

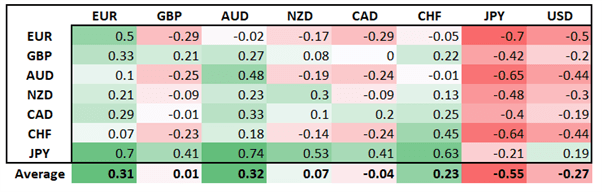

Intra-Day FX Performance

The move higher in equity markets has unsurprisingly seen safe-havens the notably laggards with cross-JPY hovering around intra-day highs. The Euro has recovered the 1.2100 handle with the currency given a gentle nudge following better than expected ZEW data. However, Italian politics are will be in focus today as PM Conte faces a difficult test in winning a confidence vote at the Senate.

- Should PM Conte lose the vote, if the margin is small, he could perhaps continue if support is found from independent parties, however, the government will likely remain increasingly fragile going forward (BTPs will provide a signal on sentiment).

- If support is not found, Italy could once again be heading to the polls, which would be the most negative outcome for the Euro and BTPs.

How to Trade the Impact of Politics on Global Financial Markets

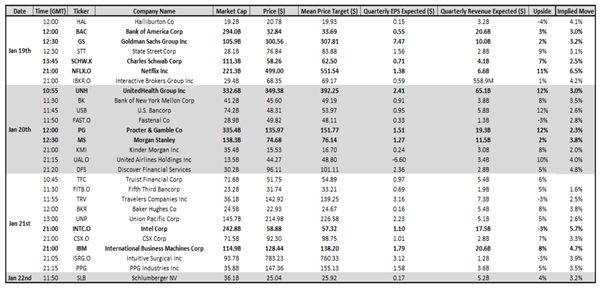

US CORPORATE EARNINGS FOR THE WEEK

Source: DailyFX, BBG, Refinitiv